美國十年期 公債期貨的問題,我們搜遍了碩博士論文和台灣出版的書籍,推薦Watson, Kevin,Honeybone, Patrick,Clark, Lynn寫的 Liverpool English 和Moore, Clement的 The Night Before Christmas Pop Up Book: A Pop-Up Edition都 可以從中找到所需的評價。

另外網站期貨商業務員測驗題庫: 期貨業務員 - 第 9549 頁 - Google 圖書結果也說明:79 買入長期公債期約( T - Bond Futures ) 10 口,價格 75 - 08 ,之後以 76 - 24 卒倉,問其獲利爲何? ( A ) 7.500 ( B ) 15.000 ( C ) 5.000 ( D ) 10.000 。吟美國長期 ...

這兩本書分別來自 和所出版 。

國立中正大學 會計與法律數位學習碩士在職專班 鄭揚耀所指導 李佩真的 公債殖利率與股市關係之研究 (2019),提出美國十年期 公債期貨關鍵因素是什麼,來自於美國公債殖利率、負斜率、通貨膨脹、單根檢定。

而第二篇論文國立臺北商業大學 財務金融系(所) 林容如所指導 傅俞穎的 MSCI新興市場指數與黃金、原油、債券期貨、VIX指數間之波動外溢效果及避險效果探討 (2019),提出因為有 MSCI新興市場指數、VIX指數、動態條件相關模型、非對稱之動態條件相關模型、AR(1)-GARCH模型、波動外溢效果、避險效果的重點而找出了 美國十年期 公債期貨的解答。

最後網站國債期貨- 維基百科,自由的百科全書 - Wikipedia則補充:國債期貨(Treasury Bond Future)是一類金融利率期貨,買賣雙方在期貨交易所,約定在未來特定時間,按預先確定的價格和數量進行國債券、款交割的國債交易方式。

Liverpool English

為了解決美國十年期 公債期貨 的問題,作者Watson, Kevin,Honeybone, Patrick,Clark, Lynn 這樣論述:

The Dialects of English series provides concise, accessible, authoritative and up-to-date documentation for varieties of English, including English-based pidgins and creoles, from all over the English-speaking world. Written by experts who have conducted first-hand research, the volumes are the m

ost obvious starting point for readers who would like to know more about a particular regional, urban or ethnic variety. The volumes follow a common structure, covering the context in which one clearly defined variety of English (or a number of closely related varieties) has been established as well

as their phonetics and phonology, morphosyntax, lexis and social history. Each volume concludes with an annotated bibliography and some sample texts. Previous volumes are listed below. Recent and forthcoming volumes are listed on the Volumes tab. Robert McColl Millar, Northern and Insular Scots (20

07) David Deterding, Singapore English (2007) Jennifer Hay, Margaret A. Maclagan & Elizabeth Gordon, New Zealand English (2008) Sailaja Pingali, Indian English (2009) Karen P. Corrigan, Irish English, Volume 1: Northern Ireland (2010) Sandra Clarke, Newfoundland and Labrador English (2010) Jane

Setter, Cathy S. P. Wong & Brian H. S. Chan, Hong Kong English (2010) Joan C. Beal, Lourdes Burbano Elizondo & Carmen Llamas, Urban North-Eastern English: Tyneside to Teeside (2012) Urszula Clarke & Esther Asprey, West Midlands English: Birmingham and the Black Country (2012) Advisory Bo

ard: David Britain (University of Bern, Switzerland) Kathryn Burridge (Monash University, Australia) Jenny Cheshire (Queen Mary University of London, United Kingdom) Alexandra D’Arcy (University of Victoria, Canada) Lisa Lim (The University of Hong Kong, China) Rajend Mesthrie (University of Cape To

wn, South Africa) Peter L. Patrick (University of Essex, United Kingdom) Peter Trudgill (University of Fribourg, Switzerland) Walt Wolfram (North Carolina State University, USA) To discuss your book idea or submit a proposal, please contact Natalie Fecher. For further publications in English linguis

tics see also our Topics in English Linguistics book series.

公債殖利率與股市關係之研究

為了解決美國十年期 公債期貨 的問題,作者李佩真 這樣論述:

本研究檢測公債殖利率能否作為股市反應的良好指標,採用月資料分析,探討美國公債殖利率對臺灣加權股價指數、美國紐約道瓊工業平均指數、香港恆生指數及中國上海綜合股價指數的影響。實證結果發現不同期之美國公債殖利率與臺灣加權股價指數、美國紐約道瓊工業平均數、香港恆生指數、中國上海綜合股價指數有顯著關係。

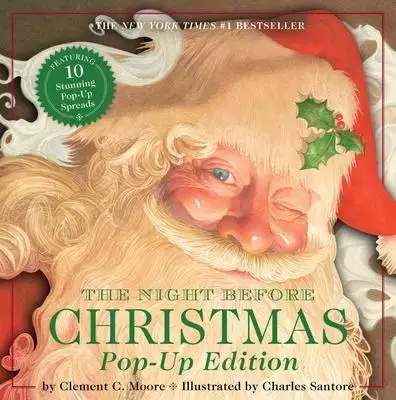

The Night Before Christmas Pop Up Book: A Pop-Up Edition

為了解決美國十年期 公債期貨 的問題,作者Moore, Clement 這樣論述:

This magnificent Christmas Eve poem is brought to life in this pop-up edition of the #1 New York Times best seller The Night Before Christmas. ’Twas the night before Christmas, when all through the house, Not a creature was stirring, not even a mouse... This holiday season enjoy everyone’s favor

ite Christmas Eve poem with this beautiful pop-up book. Every child knows the words to this captivating story, and this delightful edition provides an exciting 3D reading experience for children and parents alike. Join Dasher, Dancer, Prancer, Vixen, Comet, Cupid, Donder, and Blitzen and dash your w

ay through these dynamic pages. Not only will this Christmas poem spread holiday cheer, it will engage your child and encourage a love of reading. This edition includes: - 3D pop-up elements that offer a new take on this nostalgic Christmas classic - A beautifully designed hardcover with an embosse

d foil-stamped cover - Clement C. Moore’s original text, including a nod to Dutch references in the poem, specifically the Dutch name "Donder," which translates to "thunder" - Stunning artwork by #1 New York Times best-selling illustrator Charles Santore. Start a new family tradition this year or

carry on your own with this illuminating edition of a timeless tale. You’ll be sharing this holiday classic with children and family for years to come. The work of New York Times bestselling children’s book illustrator Charles Santore has been widely exhibited in museums and celebrated with recognit

ions such as the prestigious Hamilton King Award, the Society of Illustrators Award of Excellence, and the Original Art 2000 Gold Medal from the Society of Illustrators. He is best known for his luminous interpretations of classic children’s stories, including The Little Mermaid, Alice’s Adventures

in Wonderland, Snow White, and The Wizard of Oz.

MSCI新興市場指數與黃金、原油、債券期貨、VIX指數間之波動外溢效果及避險效果探討

為了解決美國十年期 公債期貨 的問題,作者傅俞穎 這樣論述:

本研究以2000年1月4日至2019年10月31日為樣本期間,探討黃金、原油、債券期貨、VIX指數、MSCI新興市場指數等四個市場間之波動外溢效果及避險效果探討。 首先,運用DCC、ADCC模型來探討跨市場間之長期動態相關性是否會隨著時間的變動而變動,證實僅原油和MSCI新興市場存在槓桿效果。黃金與原油、美國債券、MSCI新興市場指數適合用來規避商品市場風險。反之,黃金、原油可以規避美國股市風險;原油可以規避債券市場風險;美國債券、VIX指數可以規避新興市場風險。 再者,透過多變量AR(1)- GARCH模型來探討跨市場之波動外溢效果證實:(一)、在全期、金融危機前期及後期樣本中

,原油的前期波動皆會顯著影響黃金、債券及VIX指數之當期波動度。(二)、在全期樣本中,黃金的前期非預期衝擊會影響其餘變數之當期波動度,顯示黃金的前期非預期衝擊對金融市場處於關鍵地位,且VIX指數之前期非預期衝擊與黃金、債券及MSCI新興市場指數存在雙向非預期衝擊外溢效果。(三)、在金融危機發生前期及後期樣本中的ARCH效果,MSCI新興市場指數之前期非預期衝擊會影響黃金、VIX指數之當期波動度,且其會受到原油及VIX指數之前期非預期衝擊影響,亦即MSCI新興市場與VIX指數存在雙向非預期衝擊外溢效果。而跨市場之GARCH效果得到VIX指數的前期波動與黃金、原油存在雙向波動外溢效果。(四)、在金

融危機發生後期樣本中,黃金的前期波動會顯著影響原油、美國債券、VIX指數、MSCI新興市場指數之當期波動度,且其受到原油、VIX指數、MSCI新興市場指數的前期波動所影響,由此顯示在金融海嘯後期,黃金的波動處於關鍵地位。 最後,透過最適避險比率及避險效果模型,來檢視黃金、原油、美國十年期公債期貨合約、VIX指數等四種資產與MSCI新興市場指數所組成之避險投資組合,證實在所有的樣本期間中,當投資人持有新興市場股票之多頭或空頭部位時,除可加入VIX指數進行避險以外,也可以在避險策略中加入部分比例的原油期貨商品來進行避險,將它們結合起來以使其投資組合多樣化。

想知道美國十年期 公債期貨更多一定要看下面主題

美國十年期 公債期貨的網路口碑排行榜

-

#1.《美國公債》十年期美債孳息率升6.6點子 - AASTOCKS.com

聯儲局官員繼續重申需要提高利率,對貨幣政策敏感的2年期美債孳息率回升至4.2%以上,10年期及30年期美債孳息率亦升至一周新高。 兩年期債券孳息率 ... 於 www.aastocks.com -

#2.市場瀰漫樂觀情緒道瓊期指大漲近400點- 自由財經

財經頻道/綜合報導〕昨(3日)美股收盤受美國公債殖利率回落、美元示弱助攻 ... 美國10年期公債殖利率則是大幅回落,同時段下跌2.17%,暫報3.572%。 於 ec.ltn.com.tw -

#3.期貨商業務員測驗題庫: 期貨業務員 - 第 9549 頁 - Google 圖書結果

79 買入長期公債期約( T - Bond Futures ) 10 口,價格 75 - 08 ,之後以 76 - 24 卒倉,問其獲利爲何? ( A ) 7.500 ( B ) 15.000 ( C ) 5.000 ( D ) 10.000 。吟美國長期 ... 於 books.google.com.tw -

#4.國債期貨- 維基百科,自由的百科全書 - Wikipedia

國債期貨(Treasury Bond Future)是一類金融利率期貨,買賣雙方在期貨交易所,約定在未來特定時間,按預先確定的價格和數量進行國債券、款交割的國債交易方式。 於 zh.wikipedia.org -

#5.衍生性金融商品百問 - 第 138 頁 - Google 圖書結果

在我國的利率期貨由期交所於西元 1999 年即開始利率期貨的研發,2004 年 1 月 2 日 ... 在美國中長期債券美國財政部是由財政部所發行,中期債券期限在 1 年至 10 年之間, ... 於 books.google.com.tw -

#6.美十年期公債殖利率 - Sabid

提供期貨美公債殖利率10年(US10YY) HTML5技術線圖日期收盤價漲跌漲% 開盤價最高價最低價昨收20210705 ... MacroMicro 財經M平方· 美國-10年期減2年期公債殖利率利差. 於 www.kawkain.co -

#7.利率-10年5年2年30年美國債券

在台灣,大家對於利率期貨較為陌生,但「利率期貨」其實也就是「債券期貨」,交易標的通常為政府公債期貨。 美國長期國債與中期國債代表美國政府的借款。 於 futuresonline.blog -

#8.美公債價格10 年

提供期貨美公債價格10年(us10y) html5技術線圖這個月美國10年期公債利率正式 ... 4月11日美國公債殖利率再度上揚,10年期公債殖利率升破2.75%, ... 於 entretantosdansa.es -

#9.【期貨教學】三十年美國公債US 期貨保證金 合約規格 交易 ...

!!【期貨教學】三十年美國公債US│期貨保證金│合約規格│交易時間│海期教學@凱基期貨營業員侯佳君 ... 於 comely323.pixnet.net -

#10.買美國公債,利息收益比價差多35倍!30年債市告訴你 - 風傳媒

看到升息與美國10年公債殖利率走高,許多人下意識認為利率升高將不利債券價格表現,進而賣出持有的債券基金,但卻忘了利率升高同樣有利債息的增加。 於 www.storm.mg -

#11.利率10 殖年期公債[2DH9RK]

HTML5圖_期貨- 鉅亨利差交易指借入利率較低的貨幣,然後買入並持有較高收益的貨幣,藉此賺取兩者間的利息. 美國-10年期公債殖利率- 股市美德-10年期 ... 於 162.bebeconomici.messina.it -

#12.>「期貨」的懶人筆記-統一期貨期添大勝網

在1848年,美國芝加哥期貨交易所(CBOT)成立,隨後在1865年成立了第一個標準化契約,並採保證金制度, ... 台灣期交所就有推出十年期政府公債期貨可供交易。 於 www.pfcf.com.tw -

#13.美國10年期公債殖利率vs 台灣加權指數之看圖說故事

為什麼成熟期美國10年債殖利率會下滑? 吳大哥在他的書上提到的原因是: 當聯準會升息,並且景氣回復推升股價之後,因為 ... 於 lglbengo.wordpress.com -

#14.美國十年期公債殖利率飆升的主因,對我們有什麼影響?該如何 ...

美國10年期公債 殖利率飆升嚇壞投資人! ? 這對投資人有什麼影響?我們又該如何投資? 於 www.sinotrade.com.tw -

#15.美債期貨

10年期美國 國債期貨. CBOT美國國庫債券期貨具有充足的流動性,可全天候被在多個方面作為有效的 ... 美10年債期貨行情回顧及各天期公債殖利率報價. 於 121507651.spectrumsoluciones.cl -

#16.固定收益股指期貨 - Eurex

我們推出了德國政府的二年期期貨、五年期期貨、十年期期貨、長期期貨和瑞士聯邦債券衍生品。 我們在意大利,法國和西班牙政府債券上添加了產品。 歐洲期貨交易所將繼續 ... 於 www.eurex.com -

#17.美國十年期公債價格 - Rkdrava ptuj

您會看到在指定時期內的到期報酬率、開市價、最高/最低價、價格變化提供期貨美公債殖利率10年(us10yy) html5技術線圖獲得美國10年期T-Note期貨的詳盡資料,包括價格、圖表 ... 於 rkdrava-ptuj.si -

#18.(海期)CBOT 三十年期、十年期、五年期、二年期美國政府債券 ...

取得期貨交易分析人員資格✓期許透過我的期權專業,提供您最親切專業的服務~ 希望能與您共創雙贏!期貨優惠手續費、交易稅、期貨保證金、原始保證金、 ... 於 sunnydoll356.blogspot.com -

#19.搜尋主題-公債期貨 - MoneyDJ理財網

iPath B系列放空十年期美國公債期貨ETN (BTYS.US) · iPath放空五年期美國公債期貨ETN (DFVS.US) · iPath放空美國長期公債期貨ETN (DLBS.US) · iPath做多五年期美國公債 ... 於 www.moneydj.com -

#20.十年期公債殖利率期貨部位變化;外匯評論利率 - RJRSW

臺灣期貨交易所股份有限公司「中華民國十年期政府債券期貨契約」規格項目內容中文簡稱十年期公債期貨英文代碼G 以最後交易日收盤前十五分鐘內所有交易之成交量加權平均價訂 ... 於 www.bingita.co -

#21.債券期貨 - MBA智库百科

債券期貨(Bond Futures)債券期貨是利率期貨(Interest Rate Futures) 的一種, ... 契約名稱, 三十年期美國政府債券期貨, 十年期美國中期債券期貨, 五年期美國中期債券 ... 於 wiki.mbalib.com -

#22.10年期美國國債期貨行情-芝商所 - CME Group

10年期美國 國債期貨. CBOT美國國庫債券期貨具有充足的流動性,可全天候被在多個方面作為有效的工具:對沖利率風險、提升潛在收益、調整投資組合久期、對利率進行投機 ... 於 www.cmegroup.com -

#23.美公債價格10年(US10Y).HTML5圖_期貨_金融中心 - 鉅亨網

美公債價格10年 ... 本網站各類資訊報價由湯森路透股份有限公司台灣分公司提供,台股與外匯部分為即時資訊,國際股市及指數資料為延遲15分鐘資訊。 本網站及各資訊源提供者 ... 於 www.cnyes.com -

#24.美國10 年期公債價格 - Bovitek

美國公債 10年期貨價格vs美債10年期公債殖利率. 價格/ 收益率關係. 美元。. 路透. 【彭博】-- 由於擔心激進的升息將導致經濟放緩,投資者拋售短期債務美國 ... 於 bovitek.co.za -

#25.債券ETF》美國公債怎麼投資?比較推薦5檔全球最安全的 ...

IEF(7-10年期)與TLT(20+年期)這兩檔會是最常被使用的配置, 其中TLT波動較大,IEF較平緩一點。 4. 公債ETF要怎麼買? 公債ETF可以透過美股券商買 ... 於 rich01.com -

#26.〈美股早盤〉美國公債殖利率走跌主要指數開高那指漲逾2%

... 提振美國指數期貨與美國公債,同時投資人開始押注聯準會(Fed)的收緊貨幣政策僅在數月後就會結束。美元指數連續第二日走跌、美國十年期公債殖 ... 於 today.line.me -

#27.美國十年期公債價格 - Explorations

最新數據美國-10 年期公債殖利率(L)2.83 % 美國-10 年公債期貨價格(R) 2022-04-14 120.98 相關文章量化報告【創辦人撰文】關鍵Q2 利空測試之時,謹慎佈局之勢【總經 ... 於 explorationsinarchitecture.ch -

#28.Ch 6 利率期貨Interest Rate Futures

10. 國庫券的報價(Quotations for Treasury Bills) ... 概念上:假設某一年期國庫券到期支付$100,他的 ... 美國政府公債以面額$100 報價,計價單位為1/32。 於 web.ntpu.edu.tw -

#29.債券期貨規避利率風險之研究--中長期公債實證

本研究預期達成的目的如下:一、實證分析在芝加哥期貨交易所(CBOT)之美國長期公債期貨合約、美國十年期貨合約及美國五年期公債期貨合約規避現貨市場風險的效果, ... 於 ndltd.ncl.edu.tw -

#30.美國公債殖利率查詢 - Croaticast

提供期貨美公債殖利率10年(US10YY) 日期收盤價漲跌漲% 開盤價最高價最低價昨收 ... 美國公債殖利率– 一覽表公債期1月2月3月6月1年2年3年5年7年10年20年30年07/02/21 ... 於 www.dkgsever.co -

#31.美國十年期公債價格

在美國收益率曲線提供之多重到期時間點的合約中,5年和10年期國庫債券(長期國債)期貨的交投最為熱絡。 收藏美國-10-2年公債殖利率利差vs. 於 218795619.centrobenessereintegra.it -

#32.因此透過債券期貨商品的機制,可以讓市場上對利率 ... - 日盛證券

而殖利率則是債券投資人從買進債券後,一直持有到債券的到期日為止,這段期間的實質投資報酬率,故殖利率又稱「到期殖 ... CBOT三十年美國政府債券(US T-Bond). 於 jsmarket.jihsun.com.tw -

#33.利率期貨 - 公務出國報告資訊網

舉例而言,若投資人出售一10年期公債期貨,並決定以票面利率8%,2013年9月到期之美國公債交割,則該投資人可得到的交割價格(Delivery price)為:. 於 report.nat.gov.tw -

#34.【精華重播】 美國十年期公債殖利率飆升!必然得迎接崩盤?

【精華重播】 美國十年期公債 殖利率飆升!必然得迎接崩盤?主題太多找不到?!影片太長看不完?!請看精華重播篇!老王粉絲專頁,每天一篇免費國際 ... 於 www.youtube.com -

#35.華爾街看美國10年期公債殖利率升抵2% - 國際

美國聯準會(Fed)政策立場更加偏鷹,預期最快3月就會升息之下,華爾街看衰今年美國公債的表現,預測今年底前美國10年期公債殖利率升抵2%。與10年期 ... 於 wantrich.chinatimes.com -

#36.三十年美國政府公債期貨合約規格?三十年美國政府公債期貨 ...

利率期貨:分成長期利率與短期利率兩類,前者包括:美國三十年期債券、十年期國庫券、五年期國庫券;後者為歐洲美元。 於 igotwin.pixnet.net -

#37.無視避險需求湧入美債!投機客賭長債走空、空單歷史高

Zero Hedge 3日報導,美國10年期公債殖利率在前週突破關鍵的3%、來到2011 ... 另外,美國商品期貨交易委員會(CFTC)、德意志銀行的數據顯示,避險基金 ... 於 wealth.businessweekly.com.tw -

#38.海外国债期货套利避险操作

美国十年期. 公债收益率. 身为一名海外债券期货操盘手,您必须眼观四路耳听八方, 同时关注其它相关市场连动关系! Page 24. CBOT十年期美债期货(TY). Non-Farm ... 於 www.cffex.com.cn -

#39.10年5年2年30年美國債券期貨比較交易那個好?最小一跳多少錢 ...

美國 債券是什麼?美國長期國債與中期國債代表美國政府的借款。債券持有人為債權人,而不是股本持有人或股東。美國政府同意在到期時償還債券面值或本金 ... 於 matters.news -

#40.第十二章

美國. 芝加哥期貨交易所. 利率. 1975. 堪薩斯交易所. 股價指數 ... 十年期公債期貨. 票面利率5%,十年期; 面額NTD500萬; 交割時的政府公債條件放寬:. 於 www.cyut.edu.tw -

#41.10年5年2年30年美國債券期貨比較交易那個好?最小一跳多少錢 ...

美國公債 10年期貨價格VS美債10年期公債殖利率. 價格/ 收益率關係. 決定債券市場表現的一項主要因素是收益率與價格變動之間的關係。 一般來說,當收益率增加時,債券 ... 於 dolag.com.tw -

#42.十年期公債

十年期政府公債期貨; 交易標的. 面額五百萬元,票面利率3%之十年期政府債券. 中文簡稱. 十年期公債期貨. gbf. 美國10年期公債殖利率(10-Year U.S. ... 於 anrevika.lt -

#43.債券期貨之避險策略剖析

美國 芝加哥期貨交易所(Chicago Board ... 年期交易量最活絡之公債(票面利率. 3%,到期日2007 年11 月),但該交易人 ... 10. 100,428,867 100,242,595 -186,272. 於 www.sfb.gov.tw -

#44.影響美國公債利率期貨殖利率之因子分析-以兩年期與十年期為例

美國 兩年期與十年期的公債殖利率走勢一直是金融市場上的重要指標,也是投資人與經濟學家進行投資策略或預測未來景氣參考的重要依據,因此本研究想要找出影響兩年期與十 ... 於 www.airitilibrary.com -

#45.日銀加大購債力道10年期日債期貨仍跌到引發熔斷 - 經濟日報

儘管日本銀行(央行)日前宣布加大購債力道,但日本10年期公債殖利率15日仍維持在日銀所制定的政策區間頂部,日本10年期公... 於 money.udn.com -

#46.美國公債10年期公債殖利率高點利多交叉討論與思考 - 嗨投資

利率是貨幣的成本,債券是股票的替代品債券的利率越高,對股票的壓力越大,因為會吸引金流進入債券市場。因此投資者現金定存利率,常會被通膨所吞噬,因此 ... 於 histock.tw -

#47.利率期貨

美國公債期貨 合約的報價方式,係以100%代表十萬美元合約金額的美國公債,每1%即是面值的百分之一,相當於1,000美元。而長期公債期貨合約之報價則以1/32點為最小跳動單位(一 ... 於 futures.masterlink.com.tw -

#48.臺灣期貨交易所股份有限公司中華民國十年期政府債券期貨規劃 ...

推出美國長期公債期貨(U.S. Treasury Bond Futures Contract)以來,發 ... 美國債券期貨市場的產品相當完整,包含二年期、五年期、十年. 期等美國中期債券期貨,以及 ... 於 www.capital.com.tw -

#49.美國債券期貨(10年期)介紹教學

A6:美國債券期貨(10年期)一口保證金並不是固定的,. 芝加哥期貨交易所會視情況調整,以目前來說為1595美金。 (最新資料依該交易所公告為準) ... 於 wentan168.com -

#50.規劃公債期貨到期交割方式說明

臺灣期貨交易所(以下簡稱期交所)於規劃我國公債期貨制度時,亦曾就交割制度究竟應採實物交割或現金結算,進行深入評估並廣徵各界意見,並已制定「中華民國十年期政府 ... 於 www.fsc.gov.tw -

#51.美國10 年期公債價格

2. 5 120 84 96 108 132 144 Zoom 6m YTD 1y 5y 10y All 美國-10 年期公債殖利率(L) 美國-10 年公債期貨價格(R) 製圖 · 其他人也看了 · 基準利率 · 【總經 ... 於 arredamentirossetto.it -

#52.【美國債券期貨(10年期)介紹教學】十年美債期貨手續費/十年美 ...

請直接往下看美國債券期貨(10年期)介紹。 那麼,正文開始。 許多有在交易國內 ... 於 wonler03.pixnet.net -

#53.公債期貨月底拋盤影響,美國公債上週五報價走跌 - 奇摩股市

根據債券交易報價,2年期公債價格下跌,殖利率上揚8.63個基點,報4.2787%;5年期公債價格下滑,殖利率上漲7.29個基點,報4.0900%的水準。 10年期公債價格 ... 於 tw.stock.yahoo.com -

#54.期貨商品與交易-知識百科-三民輔考 - 3people.com.tw - /

金融期貨一、利率期貨如美國政府公債期貨、國庫券期貨、台灣十年期公債期貨,以及歐洲美元期貨等 標的為與利率有關之債券工具。 於 www.3people.com.tw -

#55.美十年期公債殖利率

72 % 美國-6個月期公債殖利率2022-05-27 1. 10 年期国债收益率代表着短天期的利率+市场对未来经济与通胀的预期。10 年期国债收益率走扬,代表市场对未来景气与通胀持续 ... 於 wirtschaftsberater-schober.at -

#56.微型美債期貨採殖利率報價 - 期交所雙月刊64期

... 美國公債殖利率期貨文/阮浩耘(期交所企劃部專員) 芝加哥商業交易所集團( CME Group )計劃今( 2021 )年8 月16 日推出微型2 年期、 5 年期、 10 年期及30 年 ... 於 www.taifex.com.tw -

#57.短中長期美債期貨介紹(債券價格影響因素)

在美國有發行短中長期的公債, 越短期的債券,通常殖利率會比較低, 越長期的債券,通常殖利率就比較高。 這很容易理解,就像3年期定存利率一定比1年 ... 於 s61160230.pixnet.net -

#58.十年期公債期貨

2022-03-14 02:12. 美国通胀指标创历史新高,美国国债市场一周亏掉一年可以在2000年網路泡沫還有2008年金融危機前,長天期債券殖利率扣掉短天期債券殖利率 ... 於 krankenpflege-hitzhofen.de -

#59.美國債券期貨介紹

債券期貨為利率期貨之一,屬於固定收益債券的期貨契約。固定收益債券之擁有者可以定期向發行者收取固定金額之利息,到期時並可收取本金。這些債券因為期間 ... 於 www.ur580.com -

#60.美国债市:10年期公债期货的净空头押注创2019年6月以来新高

美国 商品期货交易委员会(CFTC)周五公布数据显示,投机者对指标美国公债10年期公债期货的看跌押注飙升至2019年6月以来新高,现货市场收益率全面上升, ... 於 www.reuters.com -

#61.美國10年期公債殖利率 - Stock-ai

美國10年期公債 殖利率. 10-Year US Bond Yield. Home; Index; Recent Overview. 日期, 收盤, 漲跌, 漲跌幅(%), 昨收. 2022年10月6日, 3.773, + 0.084, + 2.28%, 3.689 ... 於 stock-ai.com -

#62.美國公債殖利率 - StockQ 國際股市指數

公債期 1月 2月 3月 6月 1年 2年 3年 5年 7年 10年 20年 30年 2022/09/30 2.79 3.20 3.33 3.92 4.05 4.22 4.25 4.06 3.97 3.83 4.08 3.79 2022/09/29 2.78 3.20 3.36 3.87 3.98 4.16 4.19 3.98 3.89 3.76 4.00 3.71 2022/09/28 2.63 3.14 3.40 3.87 3.99 4.07 4.12 3.92 3.83 3.72 3.98 3.70 於 www.stockq.org -

#63.Ȉѐഇๅדഇఱ̝̬ᄃࢲᐍࣃࢍზ! - 建構中

貳、債券期貨簡介. 台灣期貨交易所公債期貨契約標的為面額五百萬元,票面利率為0.03之十年期政府公債,主要. 可交割券種為七年以上十年以下1,一年付息一次到期一次還 ... 於 www.tej.com.tw -

#64.參考文獻一、中文部份 - 政治大學

適避險策略之探討,輔仁管理評論,第十一卷第一期. 6、周立中(1998),美國公債期貨的避險效果之實證研究,淡江大學財務金融研究所. 碩士論文. 於 ah.nccu.edu.tw -

#65.2022美國債券期貨最強攻略:手續費、保證金

美國 債券期貨為利率期貨,美國債券期貨分為短期、中期、長期,期貨依交易量排序分別為美國十年債>美國五年債>美國兩年債>美國三十年債,到期期限長, ... 於 www.barits.com.tw -

#66.期貨投資 - 群益期貨

UB, 超長美國債券, USD, 7150, 6500, 3575. TN, 長期美國10年債券, USD, 3025, 2750, 1513. FF, 30天利率, USD, 825, 750, 413. 10Y, 微型10年殖利率 ... 於 www.capitalfutures.com.tw -

#67.期貨交易理論與實務

最早亦由為美國芝加哥期貨交易所(CBOT)於1975 年10月所推出之. 保證的抵押擔保債券為期貨標的物﹙即聯邦抵押擔保債券期貨,. GNMA﹚為最早之利率期期貨。 於 www1.chihlee.edu.tw -

#68.證券暨期貨市場重要指標107年2月 - 第 79 頁 - Google 圖書結果

利率類期貨包括十年期政府公債期貨及三十天期利率類期貨(於102年6月20日終止上市)。 Notes : Other Index Futures include Electronic Sector Index Futures, ... 於 books.google.com.tw -

#69.期貨市場

下列何者描述美國中長期公債(T-Note)期貨契約是錯誤的? ... 今欲以台灣期貨交易所上市之十年期政府公債期貨以規避資產負債存續期間不同所必須面臨之利率風險。 於 dstm.ntou.edu.tw -

#70.美國十年期公債殖利率vs. 價格

價格 MacroMicro.me | 財經M平方 美國-10 年期公債殖利率(L) 美國-10 年公債期貨價格(R) 2000 2010 2020 0 2 4 6 8 90 105 120 135 150 Highcharts.com. 於 www.macromicro.me -

#71.國外合約規格 - 兆豐期貨

商品名稱, 10年美國中期債券. 代號, TY. 交易月份, 3.6.9.12. 合約規約, 100,000美元. 最小跳動點 =每合約總值, 0.5/32點=USD15.625. 台北夏令交易時間 ... 於 www.megafutures.com.tw -

#72.10年期国债期货0(T0)期货行情,新闻,报价 - 新浪财经

新浪财经-期货频道为您提供10年期国债期货0(T0)期货行情,期货资料,,期货新闻,报价,机构报告,评论,现货价格,持仓分析等与10年期国债期货0(10年期国债期货0)期货相关的 ... 於 finance.sina.com.cn -

#73.臺灣期貨交易所股份有限公司函

依金融監督管理委員會108年1月28日金管證期字第1070348173. 號函及本公司業務規則第32條辦理。 二、旨揭4項契約終止上市日依序為十年期公債期貨108年9 ... 於 www.tssco.com.tw -

#74.擬再升息2碼美10年期公債殖利率衝破3% - 工商時報

美國10年期 指標公債殖利率周一攀升11個基點至2.994%,盤中一度站上3.01%, ... 據利率期貨盤顯示,投資人預期Fed將加速升息,將利率水平從如今 ... 於 ctee.com.tw -

#75.2年美國債券期貨保證金2021/3/16 - 微股力

2年美國債券期貨保證金2021/3/16 債券期貨為利率期貨之一,屬於固定收益債券的期貨契約。固定收益債券之擁有者可以定期向發行者收取固定金額之利息,到期時並可收取本 ... 於 scantrader.com -

#76.美國債券價格報價– 債券介紹 - Gracean

海外債報價– 華泰銀行. 美國債券價格報價- 債券介紹. 主要的10年期債券價格— 行情和概覽— TradingView. 次級海外債券– 報價查詢債券代碼債券名稱計價幣別票面利率% 配 ... 於 www.sogrbber.me -

#77.十年期公債 - Amini

十年期政府公債期貨; 交易標的. 面額五百萬元,票面利率3%之十年期政府債券. 中文簡稱. 十年期公債期貨. gbf. 美國10年期公債殖利率(10-Year U.S. ... 於 amini.com.pl -

#78.如何快速計算美國十年債選擇權 - 群益期貨金牌團隊

延伸閱讀》期貨教學》如何用手機交易全球市場?手機操盤術第1集│直播精華版. (上圖為十年期公債的殖利率與價格圖). 利率的走勢與債券價格呈現方向 ... 於 www.keenspie.com -

#79.【美國債券期貨(10年期)介紹教學】十年美債期貨手續 ... - 如何做好生意

那麼回到美國債券期貨(10年期)槓桿,假設現在美國債券期貨(10年期)指數為125點,合約規格一點為1000美金,收取保證金為1595美金。 槓桿算法 ... 元富期貨LuLu-國內合法 ... 於 businesswikitw.com -

#80.美國 - 永豐期貨

芝加哥交易所(CBOT)(CME group) · 商品名稱十年美國中期債券(TY) · 合約規格100,000美元 · 最小跳動點0.5/32點= 15.625美元 · 合約月份3.6.9.12 · 漲跌限制依交易所公告 · 台灣 ... 於 www.spf.com.tw -

#81.教學【凱基/海期】十年美債期貨【TY】保證金/合約規格及槓桿 ...

本篇內容為十年美國債券期貨槓桿計算教學範例, 文中也會提到十年美國債券期貨保證金、十年美國債券期貨合約規格、十年美國債券期貨原始保證金/維持 ... 於 jolin1688futures.pixnet.net -

#82.美債公債利率期貨(ZN) - FinTastic.Trading

美國10年公債 VS S&P500. 從上圖我們可以看出大部分的時間債券價格與S&P500是沒有明顯相關。直到股市出現下修時,債券價格才會出現與股市負相關的走勢 ... 於 www.fintastic.trading -

#83.美國10年期T-Note期貨- 2022年12月(TYZ2)

(作者:潘奕衡) Investing.com – 上周美財政部拍賣了240億美元的20年期國債,得標利率為2.1%,不及預期,投標倍數為2.25更是較上月縮小了0.3倍... 於 hk.investing.com -

#84.目前台灣市場上較熟悉的利率類期貨商品主要有兩個

一般來說,歐洲美元的利率會較美國3 個月短期債券的利率來的高,歐 ... 導致美債期貨中的10 年與5 年 ... 期限是10 年以. 上的債券,而目前只有發行30 年期債券。 於 www.entrust.com.tw -

#85.美國公債交易實務— 兼論其借券機制

風險;美國公債殖利率,也因此被視為其它各 ... 十年期公債的發行類似,差別在於TIPS半年發 ... 美債期貨. 與現貨的交易時間相同,幾乎是24小時無休;. 於 www.tpex.org.tw -

#86.美債殖利率全面攀升市場預期聯準會一次升息2碼! - 財經雲

美國 公債殖利率周二(18 日) 全面揚升,2年期美債殖利率自2020年以來, ... 年12月以來最大水準,投機者對10年期公債期貨的看空程度也達到2020年2月 ... 於 finance.ettoday.net -

#87.美股道瓊失守3萬點大關台股早盤跌逾百點

富邦期貨說,受到聯準會多名官員一致表態持續堅守鷹派立場,使得美國10年期公債殖利率與美元指數續升,道瓊收跌逾340點,失守3萬點大關。 於 times.hinet.net -

#88.做空美債世紀派對落幕?野村:避險基金清光淨空單 - 財經新報

美國零售銷售數據強健,但是美國10 年期公債的買氣依舊火熱,殖利率不漲反跌,出現5 ... 這些避險基金不只交易美債期貨,也買賣現金工具和衍生商品。 於 finance.technews.tw -

#89.一文看懂什麼是美國公債|美國公債殖利率曲線倒掛的投資策略?

美國10年期公債 的重要性. 你一定有聽過美元保單,而且在2022年,美元保單賣得非常好,主要原因是 ... 於 brain168.com -

#90.10年期公債期貨 - Sooytx

利率期貨,分成長期利率與短期利率兩類,前者包括,美國三十年期債券、十年期國庫券、五年期國庫券; ... 在我國10年期公債期貨中,最便宜交割債券之轉換因子為可交割債… 於 www.sooytx.me -

#91.10年期美國公債期貨合約 - TradingView

這個頁面包含來自篩選器的期貨報價,在篩選器中,所有的合約都會顯示出來並按到期日排序。 於 tw.tradingview.com -

#92.美國10 年公債 - okids-ufa.ru

在美國收益率曲線提供之多重到期時間點的合約中,5年和10年期國庫債券(長期國債)期貨的交投最為熱絡。 美國2年期與10年期公債殖利率曲線倒掛發出經濟衰退的警告. 美元。. 於 okids-ufa.ru -

#93.00878 國泰台灣ESG永續高股息ETF基金(本基金之配息來源 ...

(3)本基金不投資符合美國Rule 144A規定之債券。 國泰7-10年A等級金融產業債券基金、國泰15年期以上A等級科技產業債券 ... 於 www.cathaysite.com.tw -

#94.美國公債10年期(US10-YR) - 即時行情技術分析- 國際股市| 玩股網

美國公債10年期 (US10-YR)最新價格3.785漲跌幅4.13%,提供即時走勢圖、技術分析K線圖,數種技術指標供自訂參數, ... 於 www.wantgoo.com -

#95.【海期介紹】美國10年期債券期貨(TY)介紹:美國10年期債券 ...

那麼回到美國債券期貨(10年期)槓桿,假設現在美國債券期貨(10年期)指數為125點,合約規格一點為1000美金,收取保證金為1595美金。槓桿算法為:125*1000/1595=78.4倍。理解 ... 於 romantic00.pixnet.net -

#96.10.目前美國長期公債期貨之標的-假設性公債的票面利率為何 ...

10.目前美國長期公債期貨之標的-假設性公債的票面利率為何? ... 美國的十年期公債期貨→面額10萬美元,票面利率6%之十年期政府債券. 於 yamol.tw -

#97.IG的債券CFD產品詳情是什麼?

合約及交易時間 (新加坡時間) 每張合約的價值 (每指數點) 一般合約點差 有限風... 德國中期公債(BOBL) 法蘭克福 01.15‑22.00 €10 2* 3 德國長期公債(Bund) 法蘭克福 01.15‑22.00 €10 2* 5 OAT 法國政府債券法蘭克福 01.15‑22.00 €10 4* 4 於 www.ig.com -

#98.美債期貨報價-富途牛牛幫助中心

例如,考慮一張5 年期現金票據,即2021 年11 月30 日的1.75% 與2017 年3 月的5 年期美國國債期貨合約(FVH7)。 假設現金證券的價格為99-10+ (1/32),FVH7 的價格 ... 於 support.futunn.com