Typical investor的問題,透過圖書和論文來找解法和答案更準確安心。 我們找到下列股價、配息、目標價等股票新聞資訊

Typical investor的問題,我們搜遍了碩博士論文和台灣出版的書籍,推薦Picheny, Matt寫的 Backstage Guide to Real Estate: Produce Passive Income, Write Your Own Story, and Direct Your Dollars Toward Positive Change 和BradFeld的 創業投資聖經:Startup募資、天使投資人、投資契約、談判策略全方位教戰法則【暢銷10週年‧最新增訂版】都 可以從中找到所需的評價。

另外網站What is Fixed Income Investing? | BlackRock也說明:Investors who are closer to retirement may rely on their investments to provide income. Because fixed income typically carries less risk, these assets can be a ...

這兩本書分別來自 和野人所出版 。

國立高雄大學 金融管理學系碩士班 黃一祥所指導 林昀正的 實證台灣上市股票短期動能: 應用 Yang and Zhang (2019) 的方法 (2021),提出Typical investor關鍵因素是什麼,來自於價格動能、動能崩潰、動能策略。

而第二篇論文國立高雄科技大學 國際企業系 陳昇鴻所指導 林斌漢的 散戶投資人的股票投資信念:台灣的實證分析 (2021),提出因為有 信念、股票市場、投資決策、平均報酬率、異質性的重點而找出了 Typical investor的解答。

最後網站3 typical investor responses Getting to know your risk tolerance則補充:You invested your startup capital of GHC 10,000 with an investment bank last year. The plan was to keep it there for at least 5 years to get some returns on ...

Backstage Guide to Real Estate: Produce Passive Income, Write Your Own Story, and Direct Your Dollars Toward Positive Change

為了解決Typical investor 的問題,作者Picheny, Matt 這樣論述:

What if you can create financial freedom and save the world?Pulling back the curtain, Matt Picheny reveals the power of purposeful investing to improve life for you, your family, and even the world, one passive investment at a time. His uncommon journey from actor to real estate investor exposes

the power of passive income to liberate you from a future of necessity, setting you financially free to write your own story.From the thrill of victory to the agony of defeat, Matt takes us along on his eclectic path to financial freedom, sharing lessons learned (sometimes the hard way) to help ligh

t our way forward. Building a portfolio alongside his day job, Matt rescripted typical real estate investing strategy with his value-centric approach that benefits both residents and investors.From a starter home in Washington Heights to flipping houses and ultimately finding his niche in apartment

syndication, Backstage Guide to Real Estate shares the keystone concepts of property ownership and wealth management that Matt learned along the way.You’ll discover: The tell-tale signs of a great real estate investmentHow to improve the value of a rental through minor improvements and upgradesBegin

ning and advanced strategies for buying, selling and managing properties remotelyThe most important factors to consider when vetting a syndication dealHow to use your money to improve life for your residents and your communityWith an optimistic win-win approach and practical advice, Backstage Guide

to Real Estate is for busy business entrepreneurs, inspired leaders, nomadic visionaries, and change agents everywhere, who want direct the power of their investment dollars to make positive changes in their world.

Typical investor進入發燒排行的影片

What Should You Do With Extra Money? Spend It? Invest In Stock? Build A Business? Take Your Chance To Ask Dan Lok A Question By Joining The FREEDOM Challenge Here: https://extramoney.danlok.link

Got extra money in the bank? Investing extra money is always a good idea. But what should you invest in? Watch the video as Dan Lok explains his investment principles. Share this video with a fellow investor.

? SUBSCRIBE TO DAN'S YOUTUBE CHANNEL NOW ?

https://www.youtube.com/danlok?sub_confirmation=1

Check out these Top Trending Playlists -

1.) Boss In The Bentley - https://www.youtube.com/playlist?list=PLEmTTOfet46OWsrbWGPnPW8mvDtjge_6-

2.) Sales Tips That Get People To Buy - https://www.youtube.com/watch?v=E6Csz_hvXzw&list=PLEmTTOfet46PvAsPpWByNgUWZ5dLJd_I4

3.) Dan Lok’s Best Secrets - https://www.youtube.com/watch?v=FZNmFJUuTRs&list=PLEmTTOfet46N3NIYsBQ9wku8UBNhtT9QQ

Dan Lok has been viewed more than 1.7+ billion times across social media for his expertise on how to achieve financial confidence. And is the author of over a dozen international bestselling books.

Dan has also been featured on FOX Business News, MSNBC, CBC, FORBES, Inc, Entrepreneur, and Business Insider.

In addition to his social media presence, Dan Lok is the founder of the Dan Lok Organization, which includes more than two dozen companies - and is a venture capitalist currently evaluating acquisitions in markets such as education, new media, and software.

Some of his companies include Closers.com, Copywriters.com, High Ticket Closers, High Income Copywriters and a dozen of other brands.

And as chairman of DRAGON 100, the world’s most exclusive advisory board, Dan Lok also seeks to provide capital to minority founders and budding entrepreneurs.

Dan Lok trains as hard in the Dojo as he negotiates in the boardroom. And thus has earned himself the name; The Asian Dragon.

If you want the no b.s. way to master your financial destiny, then learn from Dan. Subscribe to his channel now.

★☆★ CONNECT WITH DAN ON SOCIAL MEDIA ★☆★

YouTube: http://youtube.danlok.link

Dan Lok Blog: http://blog.danlok.link

Dan Lok Shop: https://shop.danlok.link

Facebook: http://facebook.danlok.link

Instagram: http://instagram.danlok.link

Linkedin: http://mylinkedin.danlok.link

Podcast: http://thedanlokshow.danlok.link

#DanLok #MoneyTips #Investing

Please understand that by watching Dan’s videos or enrolling in his programs does not mean you’ll get results close to what he’s been able to do (or do anything for that matter).

He’s been in business for over 20 years and his results are not typical.

Most people who watch his videos or enroll in his programs get the “how to” but never take action with the information. Dan is only sharing what has worked for him and his students.

Your results are dependent on many factors… including but not limited to your ability to work hard, commit yourself, and do whatever it takes.

Entering any business is going to involve a level of risk as well as massive commitment and action. If you're not willing to accept that, please DO NOT WATCH DAN’S VIDEOS OR SIGN UP FOR ONE OF HIS PROGRAMS.

This video is about What To Do With Extra Money In The Bank?

https://youtu.be/p7wvfJDL86s

https://youtu.be/p7wvfJDL86s

實證台灣上市股票短期動能: 應用 Yang and Zhang (2019) 的方法

為了解決Typical investor 的問題,作者林昀正 這樣論述:

本文主要研究台灣上市股票短期價格動能策略在 2000 年後的獲利能力,以及應用 Yang and Zhang (2019)的方法,在移除相對強度動能投資組合中極端絕對強度的股票後, 是否可以減緩傳統動能策略會面臨的動能崩潰問題。我們也檢驗 Yang and Zhang (2019)的策略是否可以提升台股短期價格動能策略整體的績效,並分析整體報酬提升主要的原 因。本研究的結論證實了台股短期相對動能策略在2000年後確實無利可圖,動能崩潰 確實大幅降低其獲利能力。但在利用 Yang and Zhang (2019)的策略後,可以有效減緩崩 潰最嚴重時期的負報酬,最後我們發現此方法可以進一步提升台

灣上市股票短期動能策 略整體的報酬,且此提升主要源自於避免了動能崩潰。

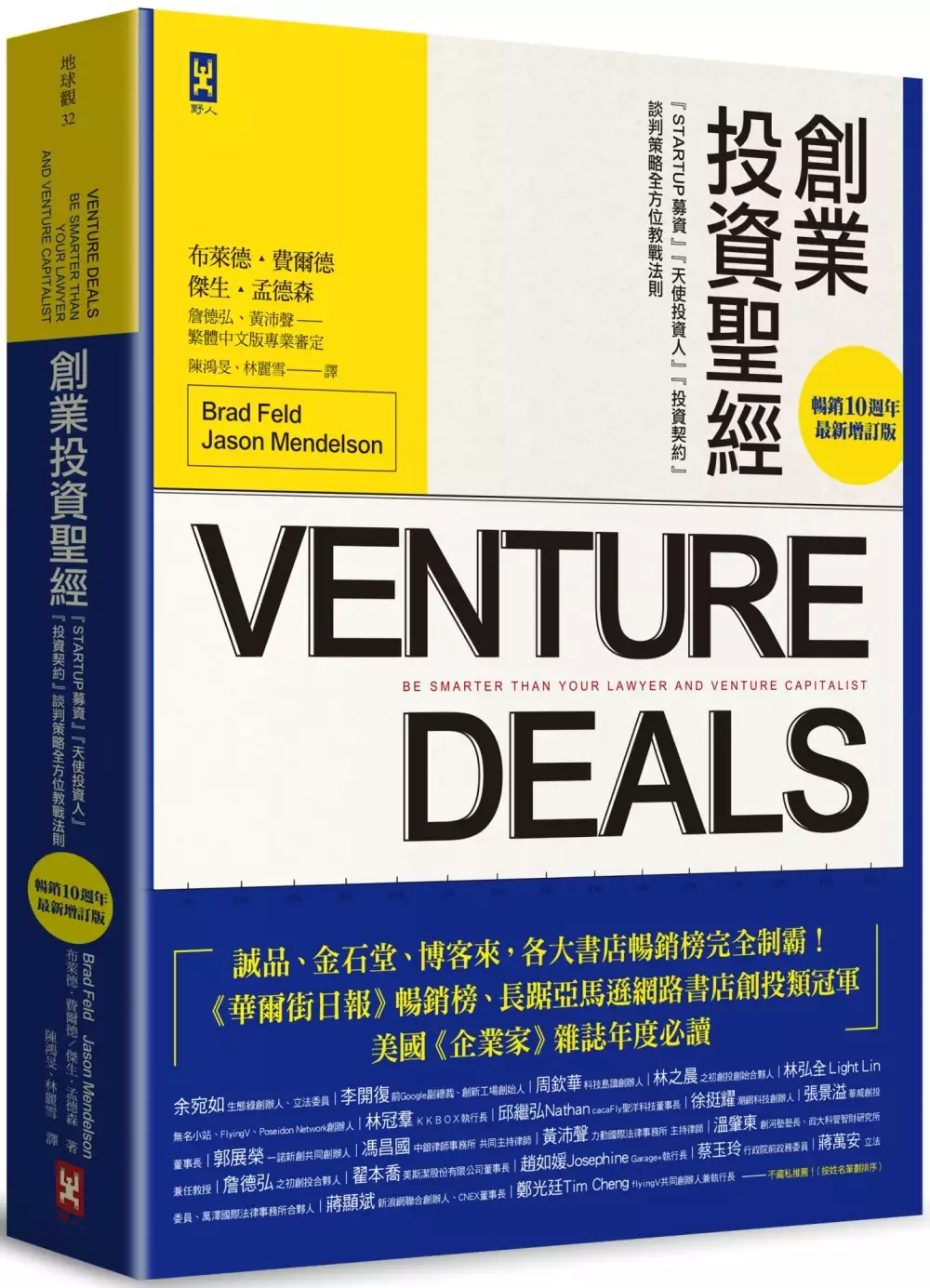

創業投資聖經:Startup募資、天使投資人、投資契約、談判策略全方位教戰法則【暢銷10週年‧最新增訂版】

為了解決Typical investor 的問題,作者BradFeld 這樣論述:

正是這套夢幻法則,造就矽谷成為創業家與投資家的天堂樂園! \Twitter 前CEO 迪克‧科斯特洛:「我創業的時候怎麼會沒有這本書呢?」/ ☆誠品、金石堂、博客來,各大書店暢銷榜完全制霸! ☆《華爾街日報》暢銷榜、長踞亞馬遜網路書店創投類冠軍 ☆美國《企業家》雜誌年度必讀 增訂六個全新章節! 詳解股權結構表、探討群眾募資需要注意什麼法律問題,股權該如何分配?建議何時該讓創投銀行介入、解析條件書的必要與重要性……豐富內容不藏私全公開! 原始章節大幅修訂新增即時資訊! 繁體中文版 獨家加注台灣「在地觀點」! 作者布萊德.費爾德與傑生.孟德森 以近30

年、數百次參與創業投資的經驗,傳授給讀者: 撰寫投資條件書的藝術 討論參與創業投資各個面向的參與者 如何融資並了解投資協議的具體條款 融資時的談判技巧、法律問題 以及所有創業者、投資人應該知道並熟記的所有知識與技巧…… 本書從創業投資條件最簡單的來龍去脈說起,先介紹參與創投交易的各方人馬。 接著談到如何籌錢,包括判斷「應該籌多少錢」,還有踏上籌資道路之前,需要哪些東西。這部分會講到許多創投人士決定投資時所遵照的程序。 再來是深入創投投資條件的細項,此處分成三章:「牟利的條件、控制權的條件、其餘條件」。我們在細項條件,力求觀點平衡,加上策略的輔佐,以圖公道地

做生意。 後續會談到條件,有談「可轉換證券的方法」,再公開「創投商人的手法」,包含動機和報酬;接著會討論現實結構面如何影響一家公司籌資成敗,或在投資作成事後影響「創投人士、創投廠商、創業人士」三者的關係。 本書會初步講到談判,及特定策略在創投界是加分還是扣分,因為這在募資的過程中至關重要。我們也有意幫創業人士避免常見的錯誤或圈套,同時圓滿完成創投融資的交易。 世上沒有所謂標準的創投融資,各項議題會考量公司不同階段籌資納入考量。 本書特別用一章是講創業人士要知道的其他重要投資條件:向你收購公司的合同意向書。 最後以數個新創公司大多會面臨到的法律層面問題作結。本書也

許沒辦法像論文那樣洋洋灑灑,羅列所有創業須知,不過已納入數個作者認為創業理當注意的重點。 ★新創的世界瞬息萬變,初版已是必讀聖經,二版新增逾八萬字內容,完整抓住趨勢脈動,趁勝追擊,擴大公司規模!★ 名人推薦 余宛如(生態綠創辦人、立法委員)、 李開復 (前Google副總裁、創新工場創始人) 、 周欽華(科技島讀創辦人) 、 林之晨(之初創投創始合夥人) 林弘全 Light Lin (無名小站、FlyingV、Poseidon Network創辦人) 、 林冠羣(KKBOX執行長) 邱繼弘Nathan (cacaFly聖洋科技董事長) 、 徐挺耀(潮網

科技創辦人) 、 張景溢 (華威創投董事長)、 郭展榮(一諾新創共同創辦人) 、 馮昌國(中銀律師事務所 共同主持律師)、 黃沛聲(力勤國際法律事務所 主持律師) 、 溫肇東 (創河塾塾長、政大科管智財研究所兼任教授)、 詹德弘(之初創投合夥人)、 翟本喬 (美斯潔股份有限公司董事長)、 趙如媛Josephine (Garage+執行長)、 蔡玉玲 (行政院前政務委員) 、 蔣萬安 (立法委員、萬澤國際法律事務所合夥人)、 蔣顯斌(新浪網聯合創辦人、CNEX董事長)、 鄭光廷Tim Cheng (flyingV共同創辦人兼執行長)……等不藏私推薦

(按姓名筆劃排序) 英文版推薦序 前Twitter CEO 迪克‧卡斯特羅 聯邦廣場創投公司合夥人 佛瑞德・威爾遜 Fitbit公司共同創辦人兼執行長 詹姆斯・帕克 中文版推薦序 中銀律師事務所共同主持律師 馮昌國 力勤國際法律事務所主持律師 黃沛聲 創河塾塾長、政大科技管理與智慧財產研究所兼任教授 溫肇東 Appworks之初創投合夥人 詹德弘(Joe) 立法委員、萬澤國際法律事務所合夥人 蔣萬安 專業審定 AppWorks之初創投合夥人 詹德弘 力勤國際法律事務所主持律師 黃沛聲

散戶投資人的股票投資信念:台灣的實證分析

為了解決Typical investor 的問題,作者林斌漢 這樣論述:

過去探討散戶投資人對股票投資平均報酬率的信念,以及這些信念如何影響他們對於證券市場交易投資決策的研究相對不足,因此本論文針對台灣一般民眾在網路上進行隨機200 份的問卷調查,實證分析散戶投資人對股票投資平均報酬率的信念。在問卷前半段詢問一般人對於證券市場交易的反應及預測,以了解個人在證券市場交易的信念及想法。隨後在中間提供一些實際的證券市場交易資訊給受訪者,告知受訪者在證券交易市場連續區間的實際投資平均報酬率。在提供實際證券市場交易資訊的後半段詢問答題者在COVID-19疫情期間及近期股市震盪的市場交易及主觀預測,以了解一般投資人是否受到外界資訊的影響而改變個別投資人的信念,並進而影響投資決

策。最後本論文分析個別投資人的投資基本背景,以了解這些背景與投資決策是否有顯著的相關性,並預測個人的信念表現對於證券市場交易會出現很大的異質性,而這些異質性是如何以因果關係影響證券交易的投資決策。

想知道Typical investor更多一定要看下面主題

Typical investor的網路口碑排行榜

-

#1.Investing in Stocks – Wells Fargo Advisors

A typical investing mistake is to concentrate a large percentage of your money in one stock or one type of stock. To help manage risk, many investors ... 於 www.wellsfargo.com -

#2.Transacting with cryptocurrency | Australian Taxation Office

Terry has been a long-term investor in shares and has a range of ... as with all of his investments, he adjusts his portfolio from time to ... 於 www.ato.gov.au -

#3.What is Fixed Income Investing? | BlackRock

Investors who are closer to retirement may rely on their investments to provide income. Because fixed income typically carries less risk, these assets can be a ... 於 www.blackrock.com -

#4.3 typical investor responses Getting to know your risk tolerance

You invested your startup capital of GHC 10,000 with an investment bank last year. The plan was to keep it there for at least 5 years to get some returns on ... 於 www.databankgroup.com -

#5.Investing in Broadway: An Overview from Jason Turchin

Unlike typical stock or real estate investments, Broadway investors may get exclusive perks which are in addition to the financial ... 於 finance.yahoo.com -

#7.How two typical investors are faring - Independent.ie

How two typical investors are faring ... The EBS Balanced fund is a typical performer over this period - i.e. it fell 20pc in two years. 於 www.independent.ie -

#8.Required rate of return definition - AccountingTools

An investor typically sets the required rate of return by adding a risk premium to the interest percentage that could be gained by investing ... 於 www.accountingtools.com -

#9.Activist funds An investor calls - The Economist

The established funds lock in their clients' money for one to two years, more than the typical hedge-fund lock-in of a few months. 於 www.economist.com -

#10.Finance Structures for PPP

Typical equity investors may be project developers, engineering or construction companies, infrastructure management companies, and private equity funds. 於 pppknowledgelab.org -

#11.Attention Receivers and Litigators: EB-5 Investors Are Not ...

... Receivers and Litigators: EB-5 Investors Are Not Your Typical Clients ... Each individual investor in these projects needs competent and ... 於 www.klaskolaw.com -

#12.Typical Mutual Fund Expense Ratios - NerdWallet

What investors need to know about expense ratios, the investment fees charged by mutual funds. Calculate the cost of your investment fees. 於 www.nerdwallet.com -

#13.The business cycle: Equity sector investing | Fidelity

Stocks have typically benefited more than bonds and cash from the typical early cycle combination of low interest rates, the first signs of ... 於 www.fidelity.com -

#14.Understanding Bond Markets: What they mean for typical ...

Investing in bonds is different from investing in stocks. Stocks represent ownership in a company. This ownership is not one where you can tell management ... 於 www.vivaldicap.com -

#15.McKinsey's Private Markets Annual Review

We typically assess meaningful change in the industry over years or ... PE investors appear to have a stronger risk appetite than they did ... 於 www.mckinsey.com -

#16.Mutual Fund Vs. ETF: Are ETFs A Better Investment? | Bankrate

Mutual funds are an older way of allowing a group of investors to own a ... tells you what a typical investor might actually be paying. 於 www.bankrate.com -

#17.Program-Related Investments | Internal Revenue Service

Examples. The following are some typical examples of program-related investments: Low-interest or interest-free loans to needy students,; High ... 於 www.irs.gov -

#18.Why Average Investors Earn Below Average Market Returns

Investor behavior is illogical and often based on emotion. This does not lead to wise long-term investing decisions. Here's an overview of a few typical money- ... 於 www.thebalance.com -

#19.10 Types of Investments and How They Work - SmartAsset

10 Common Types of Investments (and How They Work) · Stocks · Bonds · Mutual Funds · Exchange-Traded Funds (ETFs) · Certificates of Deposit (CDs). 於 smartasset.com -

#20.ESG Investing and Analysis - CFA Institute

ESG investing grew out of investment philosophies such as Socially Responsible Investing (SRI), but there are key differences. Earlier models typically use ... 於 www.cfainstitute.org -

#21.Not investing in typical GICs? Know your options - OBSI

... typical GICs or government bonds, and toward higher-yielding investments. ... a typical GIC is often not enough to provide the investor with a monthly ... 於 www.obsi.ca -

#22.Typical goals and risks | AMP Capital

What are people's goals? Throughout their lives, investors will have many different lifestyle and financial goals that they would like to achieve. 於 www.ampcapital.com -

#23.Risk, Uncertainty, and Divergence of Opinion - jstor

The mean of their appraisals will resemble the mean appraisal of the typical investor, and this will be below the appraisals of the most optimistic investors ... 於 www.jstor.org -

#24.30 Questions Angel Investors Will Ask You - Bplans Blog

When you pitch a startup to angel investors, you want to get questions. If you don't get questions then your pitch fell flat—so plan on answering questions! 於 articles.bplans.com -

#25.Chinese Investments in Norway: A Typical Case Despite ...

Chinese Investments in Norway: A Typical Case Despite Special Circumstances. Book title: Chinese Investment in Europe: A Country-Level ... 於 www.nupi.no -

#26.15 Key Questions Venture Capitalists Will Ask Before ... - Forbes

He represents newly formed and high-growth technology companies and venture and private equity investors. Larry's typical representations ... 於 www.forbes.com -

#27.Why there's no such thing as a typical year | Barclays Smart ...

While better reporting may help investors form an expectation of the typical returns they can expect from an investment, here we explore why ... 於 www.barclays.co.uk -

#28.Hedge Funds - SEC.gov

A hedge fund using leverage will typically invest both the investors' capital and the borrowed money to make investments in an effort to increase the potential ... 於 www.sec.gov -

#29.What Does an Investor Relations Manager Do? - Corporate ...

Other company structures might place it under the Legal or Accounting departments, while a few have it as a standalone department. Typical Responsibilities of ... 於 corporatefinanceinstitute.com -

#30.STRATEGIC CREDIT Typical investor profile - Finect

Typical investor profile. The Compartment is an investment vehicle for investors: › Who wish to invest in a diversified portfolio that. 於 www.finect.com -

#31.3 Types of Investors - Which One Are You? Take This Test...

Rather than become their own expert on investing, passive investors typically rely on other people's expertise for their investment strategy. 於 financialmentor.com -

#32.7 Types of Alternative Investments Everyone Should Know

The companies that issue the capital are called private debt funds, and they typically make money in two ways: through interest payments and the ... 於 online.hbs.edu -

#33.5 key characteristics of a good investor - Motilal Oswal Mutual ...

An average investor uses his money and invests the rest; a good investor invests his money and uses the rest. Investing is a risk vs. returns game. 於 www.motilaloswalmf.com -

#34.121 Mining Investment New York | Typical investor breakdown

Typical investor breakdown ... event (17-18 October 2019) attracted over 200 investors with a wide range of investment approaches and commodity preferences. 於 www.weare121.com -

#36.10 Questions to Ask Investors (Before You Take Their Money)

Raising capital for a startup is a process, not an event. It typically takes six months to raise an institutional funding round and investors ... 於 www.inc.com -

#37.typical Investor - Linguee | 中英词典(更多其他语言)

大量翻译例句关于"typical Investor" – 英中词典以及8百万条中文译文例句搜索。 於 cn.linguee.com -

#38.Investor Definition - Investopedia

Investors typically generate returns by deploying capital as either equity or debt investments. Equity investments entail ownership stakes in the form of ... 於 www.investopedia.com -

#39.Typical Investor Behavior - Intra-Focus

The answer is an emphatic no. To illustrate why, consider the two fictional investments depicted in Figure 2 below: Fund A and Fund B. 於 www.intra-focus.com -

#40.Financial Analysts : Occupational Outlook Handbook

Financial analysts recommend individual investments and collections of investments, which are known as ... Typical Entry-Level Education, Bachelor's degree. 於 www.bls.gov -

#41.Betterment

Betterment can help grow your money by making saving and investing easy. Invest in a tailored ... Typical savings account $72,763. Investing account after ... 於 www.betterment.com -

#42.2 - Private Ordering in Private Equity and Its Implications

It is noteworthy that this characteristic of a private equity investor distinguishes it not only from a typical investor in a publicly held company but also ... 於 www.cambridge.org -

#43.There is no such thing as a typical investor - Morningstar

Different sports require different skills. A sprinter will focus on developing fast-twitch muscle fibers using plyometric exercises and strength ... 於 www.morningstar.in -

#44.Which of These Seven Typical Investors Are You? - Dividend ...

While some investors would look at a portfolio full of energy stocks in a world ... As a value investor, you can quote cash flow, debt levels, and the CEO's ... 於 www.dividend.com -

#45.Investment capital - Small Business Administration

Typical investments range from $100,000 to $5 million. Debt with equity. Financing includes loans and ownership shares. Loan interest rates are typically ... 於 www.sba.gov -

#46.REMINDER: You Are 'Shockingly' Terrible At Investing

"The performance of the typical investor over this time period is shockingly poor," wrote Bernstein. "The average investor has ... 於 www.businessinsider.com -

#47.Investor Questionnaire - Vanguard

The Investor Questionnaire makes asset allocation suggestions based on information you enter about your investment objectives and experience, time horizon, ... 於 investor.vanguard.com -

#48.The Psychological Pitfalls of a Market Cycle - Advisor Channel

When it comes to investing, the focus is typically on stocks and bonds. However, in recent years, many investors have turned their attention to ... 於 advisor.visualcapitalist.com -

#49.FROM IMPACT INVESTING TO INVESTING FOR IMPACT

impact investor – diversity and inclusion, environmental sustainability, responsible ... typical stock market investor,5 and require a willingness to. 於 www.carlyle.com -

#50.Investing basics: FAQs - Charles Schwab

Do you have questions about investing? Here are Charles Schwab's frequently asked ... Index funds typically have lower costs and are more tax efficient. 於 www.schwab.com -

#51.How Venture Capital Works - Harvard Business Review

Investors in venture capital funds are typically very large institutions such as pension funds, financial firms, insurance companies, and university endowments— ... 於 hbr.org -

#52.Three charts on: who is the typical investor in the Australian ...

Contrary to the image a property investor might conjure up – a wealthy full-time property speculator – most residential investors in Australia ... 於 www.motionproperty.com.au -

#53.Stock options are not for the typical investor - Business

The problem with options for typical investors is twofold. First, the options market is not deep. For example, a stock like ExxonMobil may ... 於 www.dailycommercial.com -

#54.Overview - CVC Capital Partners

Typical Enterprise Value, €500 million - €5 billion+ ... geographically diverse and longest-established networks of any private equity investor worldwide. 於 www.cvc.com -

#55.I've just started investing in cryptocurrency. Here's what ... - ABC

As a woman in my early 40s, I'm pretty much far from the typical crypto-bro. So how far did my $100 investment get me? 於 www.abc.net.au -

#56.Rob Reid: Why suitability needs a 'typical investor' - Money ...

This was an idea borne out of Mifid. Given how few investment houses had created a 'typical investor' with suitability to match, we were clearly ... 於 www.moneymarketing.co.uk -

#57.Biglari Doesn't Like Typical Investors - Restaurant Finance ...

Sardar Biglari has never hidden his disdain for the average investor. He doesn't hold quarterly conference calls for analysts, ... 於 www.restfinance.com -

#58.White-Collar Crime - FBI

The typical investment fraud schemes are characterized by offers of low- or no-risk investments, guaranteed returns, overly-consistent returns, ... 於 www.fbi.gov -

#59.Who is the typical investor in the Australian property market?

Contrary to the image a property investor might conjure up – a wealthy full-time property speculator – most residential investors in Australia don't ... 於 raywhitebridgemandowns.com.au -

#60.Insights Library - Franklin Templeton Investments

Franklin Templeton Investment Institute. We are organized around a series of think tanks and academic partnerships to provide investors with distinct insights ... 於 www.franklintempletonnordic.com -

#61.Investors | RockStep Capital

Typically, the Manager does not take an asset management fee, development fee, fund raising fee or administrative fees. 09. WHAT IS THE TYPICAL INVESTOR PROFILE ... 於 rockstep.com -

#62.What is private equity and how does it work? | PitchBook

Typically, these investments are made into mature businesses in exchange ... Investors working at a private equity firm are called private ... 於 pitchbook.com -

#63.Multi-Asset Capabilities - Franklin Templeton

A "fund of funds" is a mutual fund that typically invests in 10-20 mutual funds or ETFs from different asset classes instead of investing directly in stocks or ... 於 www.franklintempleton.com -

#64.What do top investors 'get' that the typical investor does not?

"Angel" investing is the act of funding a startup or small business. "Angel Investors" are wealthy individuals who invest in new companies, usually with no ... 於 www.quora.com -

#65.Investor - Wikipedia

An investor is a person that allocates capital with the expectation of a future financial ... (these funds typically pool money raised from their owner-subscribers to ... 於 en.wikipedia.org -

#66.5 Types of Investors - Larta Institute

However, choosing the wrong type of investor for your individual startup ... They usually invest sizable amounts of money and are typically used once a ... 於 larta.org -

#67.Municipal Bonds | Investor.gov

Bond investors typically seek a steady stream of income payments and, compared to stock investors, may be more risk-averse and more focused on preserving, ... 於 www.investor.gov -

#68.The White Coat Investor A Doctor S Guide To Personal ...

coat investor. white coat investor investing amp personal finance for doctors. ... may 21st, 2020 - many people believe that the typical white coat investor ... 於 do1-vbox1.web.tku.edu.tw -

#69.The 'better than average' belief that could threaten your wealth

Schroders Global Investor Study 2016 found, on average, investors might be ... The 'better than average' belief of the typical investor: does it threaten ... 於 www.schroders.com -

#70.RBC Direct Investing: Online Investing and Trading

Invest your way with RBC Direct Investing. Check out our trusted trading platform for the information and tools you need to invest with confidence. 於 www.rbcdirectinvesting.com -

#71.Impact Investing - the Toniic Approach

ESG investors are typically concerned with environmental, social and governance risks and opportunities that may have “financial materiality”: those risks ... 於 toniic.com -

#72.Types of Investors: Everything You Need to Know - UpCounsel

Five common investor types for startups include: Banks; Angel investors; Peer-to-peer lenders; Venture capitalists; Personal investors. Typically, funds from ... 於 www.upcounsel.com -

#73.How to Invest in Venture Capital - US News Money

An accredited investor must have a minimum $200,000 annual income, ... confused with private equity investing, which typically funds larger, ... 於 money.usnews.com -

#74.About us - Hg Capital

Hg is a specialist private equity investor focused on software and service businesses ... over typical hold periods of approximately five years. 於 hgcapital.com -

#75.Shorting stocks is folly for the typical investor - Sarasota ...

Some investors like to live dangerously and “short” stocks. This is an undesirable way to invest for typical investors. 於 www.heraldtribune.com -

#76.The Pros and Cons of Angel Investors - The Balance Small ...

An angel investor typically looks for a return of around 25 to 60 percent. Angel investment is a form of equity financing–the investor supplies ... 於 www.thebalancesmb.com -

#77.Typical investor | Suitability | Preferred stock | Achievable

Only investors seeking income are suitable for preferred stock. If the investor is only interested in capital appreciation (capital gains), they sh... 於 app.achievable.me -

#78.Six Typical Profit-making Strategies for the Fundamental Investor

15 Sep Six Typical Profit-making Strategies for the Fundamental Investor · the dividend yield a share pays on the day you buy it (hereafter referred to as ... 於 flagshipsa.com -

#79.Help with investments | MoneyHelper

Investing your money can be a great next step when you've got to grips with saving. Explore our guidance on getting started and managing your investments. 於 www.moneyhelper.org.uk -

#80.Tiger Global: the technology investor ruffling Silicon Valley ...

The firm's swift decisions, high valuations and backing of rival start-ups sets it apart from typical venture capitalists. 於 www.ft.com -

#81.Types of Investments | FINRA.org

Think of the various types of investments as tools that can help you achieve your financial goals. Each broad investment type — from bank products to stocks ... 於 www.finra.org -

#82.How special purpose acquisition companies (SPACs) work

Following the IPO, proceeds are placed into a trust account and the SPAC typically has 18-24 months to identify and complete a merger with a target company, ... 於 www.pwc.com -

#83.Angel Investing: 20 Things Entrepreneurs Should Know

How much do angel investors invest in a company? The typical angel investment is $25,000 to $100,000 a company, but can go higher. 2. What are the six most ... 於 www.allbusiness.com -

#84.investor typical of holders of claims or interests of the relevant ...

(2) “investor typical of holders of claims or interests of the relevant class” means investor having— (A) a claim or interest of the relevant class; ... 於 www.law.cornell.edu -

#85.What is a Good Return on Investment? | The Motley Fool

Most investors would view an average annual rate of return of 10% or more as a good ROI for long-term investments in the stock market. However, ... 於 www.fool.com -

#86.Venture Capital (VC) Term Sheet: Template Examples - Wall ...

Learn about the typical terms, valuation and structure outlined in a Venture ... The investor and entrepreneur have different objectives that will play out ... 於 www.wallstreetprep.com -

#87.Getting investors on board - Business.govt.nz

Make sure you're ready, and willing, for investors to fund your business. But getting investors isn't for everyone. It takes forward planning and careful ... 於 www.business.govt.nz -

#88.Profile of a Typical Investor Sample Clauses | Law Insider

Profile of a Typical Investor. The Sub-Fund is suitable for investors with a medium-term investment horizon who are primarily seeking constant returns and ... 於 www.lawinsider.com -

#89.Cooperative Equity and Ownership: - University of Wisconsin ...

Any financial returns to cooperative owners typically come through profit ... And from a typical investor perspective, the LCA structure may not provide. 於 resources.uwcc.wisc.edu -

#90.Investment Types: See Our Offered Products - BMO

BMO has investment products for every investor, to help you reach your financial goals. ... Typical investing horizon: Short- to long-term. 於 www.bmo.com -

#91.Working with a Financial Advisor | Lord Abbett

Typical Investing Process. Working with an experienced financial advisor will go a long way toward helping investors achieve thier investment goals. 於 www.lordabbett.com -

#92.A Guide to Seed Fundraising - Y Combinator

The initial capital raised by a company is typically called “seed” capital. ... The information comes from my experiences working at startups, investing in ... 於 www.ycombinator.com -

#93.What You Need to Know about Impact Investing | The GIIN

Investors around the world are making impact investments to unleash the power of capital for ... What is the current state of the impact investing market? 於 thegiin.org -

#94.Asset Allocation: Management Style and Performance ...

It is widely agreed that asset allocation accounts for a large part of the variability in the return on a typical investor's portfolio. 於 web.stanford.edu -

#95.No Such Thing as a Typical Investor | Morningstar

Investing is a broad club: Jake Spiegel finds a better way to think about investors. 於 www.morningstar.com -

#96.Typical Greater Vancouver condo now costs $752800

TriCity News · Vancouver is Awesome · Western Investor. © 2021 Western Investor. 於 www.westerninvestor.com -

#97.Choose your investments - Moneysmart.gov.au

They aim to provide income and protect the capital invested. Defensive investments include cash and fixed interest investments. They're typically used to:. 於 moneysmart.gov.au -

#98."Cold Calling" - Investors Alert : FSA

Typically, a "cold caller" makes unsolicited calls to potential investors, cajoles them into deciding to purchase certain securities, and then, ... 於 www.fsa.go.jp