Investing的問題,我們搜遍了碩博士論文和台灣出版的書籍,推薦Kiyosaki, Robert T./ Caniglia, Shane寫的 Cash Flow Lifestyle: 8 Steps to Financial Freedom 和的 Ben Stein’’s Wisdom都 可以從中找到所需的評價。

另外網站2 Degrees Investing Initiative也說明:Aligning financial markets with climate goals. The 2° Investing Initiative (2DII) is an independent, non-profit think tank that coordinates some of the world's ...

這兩本書分別來自 和所出版 。

世新大學 財務金融學研究所(含碩專班) 吳翠鳳所指導 林昱德的 使用理財機器人的行為意圖之研究 (2022),提出Investing關鍵因素是什麼,來自於UTAUT、理財機器人。

而第二篇論文國立雲林科技大學 會計系 陳燕錫、楊忠城所指導 陳劍雄的 沙氏法對收益結構和績效之影響:臺灣會計師產業的證據 (2022),提出因為有 沙氏法、收益結構、績效、會計師產業、管制效應的重點而找出了 Investing的解答。

最後網站Impact Investing Institute則補充:At the Impact Investing Institute, we aim to transform capital markets to make ... first question about impact investment is 'so what is impact investing?

Cash Flow Lifestyle: 8 Steps to Financial Freedom

為了解決Investing 的問題,作者Kiyosaki, Robert T./ Caniglia, Shane 這樣論述:

Cash Flow Lifestyle takes us back to Robert's early journey on the road to financial freedom and his mentoring by his rich dad. This book shares many of the secrets of the rich, secrets related to how to tell the difference between advisors and salespeople, how to separate fact from opinion, how

to gain confidence related to decisions about money and investing, and how and why the rules of money have changed. These secrets form the eight building blocks to wealth that Robert and his rich dad explore in Cash Flow Lifestyle, written in the classic Rich Dad Poor Dad style of stories and contra

rian thought. To explore and uncover these secrets even further, Shane Caniglia -- entrepreneur and president of The Rich Dad Company -- expounds on the building blocks by showing how they have actually been implemented to make Rich Dad a thriving, innovative business and a powerful international br

and.

Investing進入發燒排行的影片

我非更看好第四季的加密貨幣, 這個視頻中,我們討論到了與 Twitter 整合比特幣閃電支付系統、Taproot Upgrade、比特幣智能合約、比特幣ETF、Stock-to-Flow Model等等。

本視頻中提到:Strike、Jack Mallers、Twitter、閃電支付、薩爾瓦多、Legal Tender、Western Union西聯匯款、Taproot Upgrade、比特幣智能合約、比特幣ETF、Stock-to-Flow Model、Plan B

時間軸:

0:00 Twitter閃電支付

2:19 薩爾瓦多

4:34 Taproot升級

5:12 比特幣ETF

5:44 第四季數據

6:03 Stock-to-Flow Model

6:56 結語

🔥 在 幣安 交易所交易 (全世界最大交易所,取得手續費折抵)

https://accounts.binance.me/zh-TW/register?ref=P9H7RJYN

🔥 在 Max 交易所交易(台幣出入金首選,取得手續費折抵)

https://max.maicoin.com/signup?r=3ab27dfa

🔥FTX Pro(玩以太坊、Solana鏈首選)

https://ftx.com/#a=40291297

🔥FTX(舊Blockfolio)美金賺取8%!

以零手續費交易比特幣、狗狗幣與其他加密貨幣。當您進行價值 10 美元的交易時使用我的推薦代碼並獲得免費硬幣。

https://link.blockfolio.com/9dzp/58d03a11

🔥CELSIUS BTC 賺取6.2% 並且贏得 50 美元的免費 BTC!

https://celsiusnetwork.app.link/194077575c

推薦碼:194077575c

訂閱以追蹤更多加密貨幣影片:

https://www.youtube.com/c/BradleyChung?sub_confirmation=1

👇►►► 我的社群連結 ◄◄◄👇

✅ 追蹤我的 TWITTER: https://twitter.com/yuchanchung8211

✅ 追蹤我的 INSTAGRAM: https://www.instagram.com/bradleychung6666/

✅ 追蹤我的 FACEBOOK: https://www.facebook.com/bradley.chung.58910

CREDITS: Video in the beginning by Jack Mallers

https://youtu.be/fckmC8W6yF8

CREDITS: Content inspired by JRNY Crypto

https://youtu.be/6NJPF5STxo8

CREDITS: "Subscribe Button" by MrNumber112

https://youtu.be/Fps5vWgKdl0

⚠️免責聲明:請注意,我的媒體內容只是我的個人意見,內容僅供參考,不得作為財務、法律或投資建議。 加密貨幣是非常高風險的投資,可能帶來相當大的損失風險,在投資之前,請務必深入鑽研並諮詢專業人士。

#Crypto #Bitcoin #Altcoins #Blockchain #Altcoin #Decentralized #CryptoNews #Investing #Ethereum #Ripple #Binance #Cardano #Litecoin #BullRun #PassiveIncome #StockMarket

使用理財機器人的行為意圖之研究

為了解決Investing 的問題,作者林昱德 這樣論述:

本研究以探討使用者使用理財機器人之使用行為相關研究,目的為探討使用者使用因素,提供未來後續業界之參考,以及找出現階段理財機器人使用者的描述性統計分析。本研究以有使用過銀行推出之理財機器人作為研究對象,於 2022年 7月 14日於網路進行正式問卷投放,回收後進行資料分析,經過問卷後台揭露,本次問卷研究投放人數為 4765 人,回收 490 份問卷,有效得 387份,有效回收率為 78.79%。研究架構以 UTAUT2 為基礎,並加入感知風險成為新的會影響使用意圖的因素。研究結果顯示,績效預期、社群影響、促進條件、價格價值以及習慣會對行為意圖產生顯著正向影響;努力預期以及感知風險對行為意圖則是

沒有影響;行為意圖以及習慣對使用行為有顯著正向影響;促進條件對使用意圖則無影響。希冀本研究可以作為相關單位的參考依據。

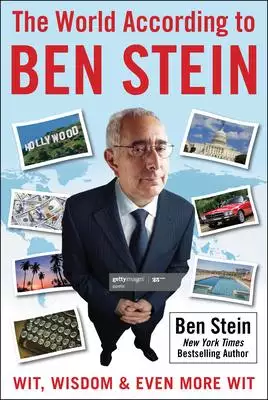

Ben Stein’’s Wisdom

為了解決Investing 的問題,作者 這樣論述:

Ben Stein (Los Angeles, CA) is the most famous economics teacher in America. His comedic role as the droning economics teacher in Ferris Bueller’s Day Off is by far the most widely viewed scene of economics teaching in economics history and has been ranked as one of the fifty most famous scenes in m

ovie history. But in real life, Ben Stein is a powerful thinkers on economics, politics, education and history and motivation - and like his father, Herbert Stein, considered one of the great humorists on political economy and how life works in this nation. Stein in real life has a bachelor’s with h

onors in economics from Columbia, studied econ at the graduate level at Yale, is a graduate of Yale Law School ( valedictorian of his class by election of his classmates in 1970), and has as diverse a resume as any man in America. His background includes...poverty lawyer for poor people in New Haven

, trade regulation lawyer for the FTC, speech writer for Presidents Nixon and Ford, columnist and editorial writer for The Wall Street Journal, columnist for The New York Times, teacher about law and economics at UC, Santa Cruz and Pepperdine. Stein was the 2009 winner of the Malcolm Forbes Award fo

r Excellence in Financial Journalism.Stein was the co-host, along with Jimmy Kimmel, of the pathbreaking Comedy Central game show, Win Ben Stein’s Money, which won seven Emmys, including ones for Ben and Jimmy for best game show host(s); surely making him the only well-known economist to win an Emmy

. Presently, he writes a column for The American Spectator and for NewsMax, and is a regular commentator on Fox News, CNN, Newsmax TV and on CBS Sunday Morning. Stein has written or co-written roughly 30 books, mostly about investing, many of them New York Times bestsellers, including: The Capitalis

t Code: It Can Save Your Life and Make You Very Rich.https: //www.mrbenstein.com/https: //www.newsmax.com/insiders/benstein/bio-39/The author lives and works in the Los Angeles metro area.

沙氏法對收益結構和績效之影響:臺灣會計師產業的證據

為了解決Investing 的問題,作者陳劍雄 這樣論述:

美國於2002年7月發布沙氏法案(The Sarbanes-Oxley Act of 2002, SOX),SOX法案及其精神導致會計師產業發生重大變化。本文探討SOX與會計師產業收益結構和績效之關聯性,使用臺灣「1992-2019年會計師事務所服務業調查報告」的22,356筆觀察資料,透過收益函數來探討SOX對會計師產業之總收益、傳統服務份額、稅務服務份額和管理諮詢服務份額之影響。同時,本研究依樣本類型分為小型、中型、大型和國際型會計師事務所,從經濟管制理論(Theory of Economic Regulation, TER)的角度,考察SOX管制制度對會計師事務所績效之影響。我們運用會

計師產業的translog收益函數,並建立了迴歸方程式來檢驗我們的假說。本研究發現SOX法案對非國際型會計師事務所的收益產生了消極影響,但對國際型會計師事務所的收益產生了積極影響。SOX法案增加了非國際型會計師事務所的稅務服務份額,同時也增加了國際型會計師事務所的稅務服務份額。此外,我們還發現SOX法案對四種不同規模的會計師事務所的經營績效都存在正向影響。進一步的結果表明,在SOX管制之下,大型和國際型會計師事務所直接獲得了管制的利益(直接管制效應),小型和中型事務所間接獲得管制的利益(間接管制效應)。本研究有助於文獻研究,為監管機構完善會計師事務所管理提供啟示。

想知道Investing更多一定要看下面主題

Investing的網路口碑排行榜

-

#1.Morningstar | Empowering Investor Success

Our independent research, ratings, and tools are helping people across the investing ecosystem write their own financial futures. 於 www.morningstar.com -

#2.Investing | The Latest News on Investing - USNews.com

Investing. Investing, a simple yet potentially powerful act, plays a major role in the U.S. market economy. It happens as people...READ MORE. 於 www.usnews.com -

#3.2 Degrees Investing Initiative

Aligning financial markets with climate goals. The 2° Investing Initiative (2DII) is an independent, non-profit think tank that coordinates some of the world's ... 於 2degrees-investing.org -

#4.Impact Investing Institute

At the Impact Investing Institute, we aim to transform capital markets to make ... first question about impact investment is 'so what is impact investing? 於 www.impactinvest.org.uk -

#5.Investing in Climate, Investing in Growth | OECD iLibrary

Investing in Climate, Investing in Growth. This report provides an assessment of how governments can generate inclusive economic growth in the short term, ... 於 www.oecd-ilibrary.org -

#6.Investing - MoneyHelper

Investing your money can be a great next step when you've got to grips with saving. You can potentially make your savings grow faster than simply putting ... 於 www.moneyhelper.org.uk -

#7.Webull - Investing in Stocks, Trading, Online Broker and ...

Enjoy Tech. Enjoy Investing. Webull offers commission-free online stock trading covering full extended hours trading, real-time market quotes, ... 於 www.webull.com -

#8.Investing.com (@Investingcom) / Twitter

Investing.com. @Investingcom. Real-time global financial market data, news, analysis, charts, tools & more • In 30 languages via our app or website ... 於 twitter.com -

#9.The Motley Fool: Stock Investing & Stock Market Research

The Motley Fool has been providing investing insights and financial advice to millions of people for over 25 years. Learn how we make the world Smarter, ... 於 www.fool.com -

#10.Investing News - CNBC

Investing. Invest in You · Personal Finance · Options Action · ETF Street · Earnings · Trader Talk. 於 www.cnbc.com -

#11.Investing in career guidance | ETF

The European Training Foundation is a European Union agency that helps transition and developing countries harness the potential of their human capital through ... 於 www.etf.europa.eu -

#12.點睇即市圖表 教你用免費網站Investing.com設定簡單指標❗️

Your browser can't play this video. Learn more. Switch camera. 於 www.youtube.com -

#13.Investing.com Stocks & Finance 4+ - App Store

This app is available only on the App Store for iPhone, iPad, and Apple Watch. Investing.com Stocks & Finance 4+. Stock Market News and ... 於 apps.apple.com -

#14.Investing: Advice, News, Features & Tips - Kiplinger

Get trusted investing advice, news and features. Find investing tips and insights to further your knowledge on kiplinger.com. 於 www.kiplinger.com -

#15.Global Impact Investing Network

New to Impact Investing? Investors around the world are unleashing the power of capital to have a positive impact on the world. How? Impact investing. 於 thegiin.org -

#16.Investing and Wealth Management Services | Wells Fargo

Wells Fargo can help with your investing, retirement and wealth management needs with financial advisors, automated investing and self-directed investing. 於 www.wellsfargo.com -

#17.Investopedia

Investopedia is the world's leading source of financial content on the web, ranging from market news to retirement strategies, investing education to ... 於 www.investopedia.com -

#18.Fidelity Investments - Retirement Plans, Investing, Brokerage ...

Fidelity Investments offers Financial Planning and Advice, Retirement Plans, Wealth Management Services, Trading and Brokerage services, and a wide range of ... 於 www.fidelity.com -

#19.Why is DYOR important while investing in crypto?

Investing in any financial asset can be hazardous when done without proper research. With the rise of digital currencies, investors must ... 於 economictimes.indiatimes.com -

#20.Stock Investing: A Guide to Value Investing

Since the publication of "The Intelligent Investor" by Ben Graham, what is commonly known as "value investing" has become one of the most ... 於 corporatefinanceinstitute.com -

#21.Share Dealing | Investing - Lloyds Bank

Share Dealing Account. If you've used up your £20,000 ISA allowance we have a flexible trading account to continue investing with. 於 www.lloydsbank.com -

#22.Investor | Research, Information & Market Updates

Read expert analysis, Investment Equipment, Stock Screeners, and Monetary Strategy Information on investing in Canada. Get best investment advice from ... 於 financialpost.com -

#23.台灣影響力投資協會-Taiwan Impact Investing Association: tiia

台灣影響力投資協會(tiia) 期望引領市場資本,共創永續價值,為社會及環境造就正面的影響力。提倡在投資獲利的同時,也評估對社會、環境、經濟等各個面向所創造正面且 ... 於 tiia.tw -

#24.Investor.gov: Home

Investing Quizzes · Investment Products ... Don't make the same investing mistakes over and over again. Read our Director's Take article to learn what NOT ... 於 www.investor.gov -

#25.Online Stock Trading, Brokerage, Investing App | SoFi

Open a brokerage account with SoFi and trade stocks online, commission-free, using our all-in-one investment app. Get started with as little as $5. 於 www.sofi.com -

#26.Investing in Canada Plan – Building a Better Canada

The Investing in Canada Plan is designed to achieve three objectives: create long-term economic growth to build a stronger middle class; support ... 於 www.infrastructure.gc.ca -

#27.Investing.com 中文網

Investing.com是全球領先的財經門戶網站,提供即時數據、報價、圖表、金融工具、最新消息和分析,範圍涵蓋全球250 間交易所,及提供44 種不同語言版本。 於 www.facebook.com -

#28.Investing News - MarketWatch

Insightful news and analysis that helps investors make crucial decisions. Providing headlines on investment strategies, investing ideas and market trends. 於 www.marketwatch.com -

#29.Rule #1 Investing - Invest Like The Best Investors In The World

Phil Town has taught over 2 million people strategies to achieve financial independence through investing. 於 www.ruleoneinvesting.com -

#30.Investing Basics | FINRA.org

Securities Investing. When most people talk about investing, they're usually referring to investments in stocks, bonds and investment funds, which are all types ... 於 www.finra.org -

#31.Investing in Nature – Private finance for nature-based resilience

NatureVest, TNC's conservation investing unit, sources private investment capital to help fund efforts to protect land and water, tackle. 於 www.nature.org -

#32.Investing - Forbes

One of the hottest trends in finance is prepaid muni bonds structured to help local utilities buy decades worth of renewable electricity. 於 www.forbes.com -

#33.Retirement, Investing and Personal Finance | T. Rowe Price

Your Personal Investing Partner. Ready to expand your investments? Add to your nest egg, open an IRA, or plan for college—we're here to help you grow your ... 於 www.troweprice.com -

#34.Should you invest? | FCA

Get your immediate finances in order before you invest. Pay off any short-term debt, have an emergency cash fund and consider investing more in your ... 於 www.fca.org.uk -

#35.PRI | Home

... Principles for Responsible Investment allows your organisation to publicly demonstrate its commitment to investing responsibly. 於 www.unpri.org -

#36.Animated Chart: The Benefits of Investing Early in Life

This animation highlights the benefits of investing early on in life by showing how much of your total earnings come from your early years. 於 www.visualcapitalist.com -

#37.Robinhood: Commission-free Stock Trading & Investing App

Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may ... 於 robinhood.com -

#38.Invest with Qtrade Direct Investing | Qtrade

Qtrade has ranked Canada's #1 online investing platform 25 times in the past 17 years, offering a superior trading experience from your desktop or mobile ... 於 www.qtrade.ca -

#39.Investing.com 帮助

最近的活动. 应用程序设置 · 如何启用通知? 文章创建于1 年前. 0. 日历 · 如何在各种财经日历之间切换? 文章创建于1 年前. 0. Investing Pro · InvestingPro同业比较. 於 www.investing-support.com -

#40.From Stocks to Crypto: Invest in 3,000+ Assets on eToro

Invest better together. since 2007. Get investment ideas from 30M users and invest in 3,000+ assets on a trusted and friendly platform. Start Investing ... 於 www.etoro.com -

#41.Investing - Nasdaq

Recent Investing headlines. Published. 1 hour ago. Trefis. Stocks · Tripadvisor Stock To Likely Trade Lower Post Q4. Published. 1 hour ago. Trefis. 於 www.nasdaq.com -

#42.Principles for successful long-term investing

Investing Principles. J.P. Morgan Asset Management ... 於 am.jpmorgan.com -

#43.Investing.com: Stocks & News - Google Play 應用程式

Join the millions of people using the Investing.com app every day to stay on top of global financial markets. Track your favorite stocks on the go and stay ... 於 play.google.com -

#44.Investing - Cash App

The stock market is open Monday–Friday from 9:30AM–4PM EST. Buying Stock. Buy a slice of your favorite company using Cash App Investing. Selling Stock. Sell ... 於 cash.app -

#45.Better Investing: Investor Education, Tools and Publications

BetterInvesting is a nonprofit organization that has helped over 5M people learn how to invest profitably in stocks of high-quality growth companies. 於 www.betterinvesting.org -

#46.World Development Report 1993 : Investing in Health

Because good health increases the economic productivity of individuals and the economic growth rate of countries, investing in health is one means of ... 於 openknowledge.worldbank.org -

#47.Investments | Financial Times

Plus, a look inside the stuttering sustainability-linked bond market. Save. February 14 2023. ESG investing · Influential local US banks fight back against ... 於 www.ft.com -

#48.Investing News Network | Investing News & Opportunities | INN

Your trusted source for investing success | Since 2008, focused news, education and expert picks in Resources, Tech, Life Science & Cannabis. 於 investingnews.com -

#49.Investing - Wealth - Bloomberg.com

Investing · Professor Emeritus of Economics at Princeton University and Rebalance Investment Committee Member Prof. Burton Malkiel · relates to The Next Big Risks ... 於 www.bloomberg.com -

#50.Globe Investor

Canada · World · Business · Investing · Watchlist · Personal Finance · Opinion · Politics · Sports · Life · Arts · Drive · Real Estate · Podcasts ... 於 www.theglobeandmail.com -

#51.Investing: Shares & saving information - The Telegraph

Investing remains the only way for savers to keep their money in line with inflation – or even beat it. By Lauren Almeida 15 Feb 2023, 9:29am. Inflation ... 於 www.telegraph.co.uk -

#52.Investing - Macquarie Bank

Looking for investment opportunities? Grow your wealth with Macquarie's investment solutions. Find out about managed funds, cash and specialised ... 於 www.macquarie.com.au -

#53.How to invest - Moneysmart.gov.au

Plan, research and diversify — these are the keys to successful investing. They'll help you find investments that fit your risk tolerance and investment ... 於 moneysmart.gov.au -

#54.Investing in Japan | Japan External Trade Organization - JETRO

Our E-mail newsletter introduces the latest investment environment information and the trends of foreign companies supported by JETRO. It includes information ... 於 www.jetro.go.jp -

#55.Investing In A Time Of Climate Change — The Sequel - Mercer

In 2011, Mercer published its first global research report on climate change and its implications for strategic asset allocation, in partnership with a ... 於 www.mercer.com -

#56.INVESTING - TheStreet

Get the latest investing news from TheStreet, where you'll find headlines about investing ideas, investment strategies, and stock market updates. 於 www.thestreet.com -

#57.How to Invest in Stocks: Quick-Start Guide for Beginners

Stock investing doesn't have to be complicated. For most people, stock market investing means choosing among these two investment types: Stock mutual funds or ... 於 www.nerdwallet.com -

#58.BlackRock: Investment Management & Financial Services

Funds that match up with investing goals and preferences. Each investor has a different story, and we are steadfast partners to our clients in the US ... 於 www.blackrock.com -

#59.Social Impact Investing

Social impact investing creates partnerships between: governments; providers; investors; philanthropists. SII Initiatives. The SII project aims ... 於 www.dss.gov.au -

#60.Folio Investing | Investment Brokerage with Commission-Free ...

Invest a smarter way. Folio Investing is an online brokerage offering financial resources and investment products such as stocks, mutual funds, and ETFs. 於 folioinvesting.com -

#61.Investing & Super - CommBank

Take control of your future with our range of investing, superannuation and retirement options. Financial Advice · Savings accounts & Term Deposits ... 於 www.commbank.com.au -

#62.Ledger Investing: Insurance-linked Securities

Ledger Investing is building an open insurance system that connects risk to capital. Institutional investors can invest in ILS while underwriters and ... 於 www.ledgerinvesting.com -

#63.Investing In Stocks The Complete Course! (17+ Hours) - Udemy

Master Stock Market Investing & Trading in the Stock Market. Top 1% Instructor & Millionaire Investor. Invest & Trade! 於 www.udemy.com -

#64.Investing News Stories - BNN Bloomberg

Most recent Investing News business news stories and video from BNN Bloomberg. 於 www.bnnbloomberg.ca -

#65.Automated Investing | Start saving better. - Betterment

Betterment can help you build wealth by making investing and saving easy: automated deposits, trading, rebalancing, portfolio selection, and more. 於 www.betterment.com -

#66.Environmental social and governance (ESG) investing - OECD

Environmental social and governance (ESG) investing. Forms of sustainable finance have grown rapidly in recent years, as a growing number of institutional ... 於 www.oecd.org -

#67.Investing in Women

Investing in Women, an initiative of the Australian Government, catalyses inclusive economic growth through women's economic empowerment in South East Asia. 於 investinginwomen.asia -

#68.Investing | Bendigo Bank

Whether you're new to investing or an expert, we can help with your investment journey. We offer Managed Funds, Share Trading and Margin Lending. 於 www.bendigobank.com.au -

#69.Investing Guide - Business Insider

Our experts bring you unbiased investing platform reviews, answer readers' most pressing questions, and provide the latest investing news. 於 www.businessinsider.com -

#70.ANZ Share Investing | Buy Shares & Trade Online

ANZ Share Investing. From October 2022, we're gradually transitioning ANZ Share Investing accounts to CMC Markets Invests – where over 1 million people ... 於 www.anz.com.au -

#71.E*TRADE | Investing, Trading & Retirement

Stop waiting. Start investing. Lifelong dreams don't need to take a lifetime with E*TRADE. 於 us.etrade.com -

#72.Vanguard: Helping you reach your investing goals | Vanguard

Vanguard funds, IRAs, 401(k) rollovers, and advice so you can sort it out. All from Vanguard, where we put you first. 於 investor.vanguard.com -

#73.Institute for Sustainable Investing - Morgan Stanley

The Institute for Sustainable Investing aims to accelerate sustainable finance and the adoption of sustainable investing strategies across capital markets ... 於 www.morganstanley.com -

#74.RBC Direct Investing: Online Investing and Trading

Invest your way with RBC Direct Investing. Check out our trusted trading platform for the information and tools you need to invest with confidence. 於 www.rbcdirectinvesting.com -

#75.WebBroker Online Trading & Investing Platform - TD Bank

The investment and trading platform from Canada's largest online broker. TD Direct Investing's WebBroker gives you all the market data and helpful tools you ... 於 www.td.com -

#76.Merrill Edge - Online Investing, Trading, Brokerage and Advice

Open an account and invest on your own terms - put your own investing ideas into action online or invest with an advisor. Access tools and research to plan ... 於 www.merrilledge.com -

#77.Charles Schwab | A modern approach to investing & retirement

Charles Schwab offers a wide range of investment advice, products & services, including brokerage & retirement accounts, ETFs, online trading & more. 於 www.schwab.com -

#78.Investing.com - Stock Market Quotes & Financial News

Investing.com offers free real time quotes, portfolio, streaming charts, financial news, live stock market data and more. 於 www.investing.com -

#79.Investing | CNN Business

Get investing advice, financial strategy, and the tools to help you make smart investment decisions. 於 www.cnn.com -

#80.Investing & Retirement Solutions from Nationwide

Investing & retirement. Nationwide can help protect your financial future. Explore our products and services here, or contact our team of specialists ... 於 www.nationwide.com -

#81.Investing in stocks for beginners: how to get started - MSE

With investing, you're taking a risk with your money. Investing is a long way from putting your cash in a savings account where it sits to earn ... 於 www.moneysavingexpert.com -

#82.Edward Jones | Make Sense of Investing

Edward Jones offers a personal approach to investing with 18000 financial advisors ready to support your retirement, education savings and insurance needs. 於 www.edwardjones.com -

#83.Guidance for Investing in Digital Health

The overarching goal is to meet the Sustainable Development Goals, particularly universal health coverage, by investing in digital health. Health care systems ... 於 www.adb.org -

#84.Stock Trading | Online Investing | Chase.com

Compare and select 1 of the 3 account types associated with Self-Directed Investing. Explore new opportunities and subscribe for exclusive market insights. 於 www.chase.com -

#85.#investing hashtag on Instagram • Photos and videos

13M Posts - See Instagram photos and videos from 'investing' hashtag. 於 www.instagram.com -

#86.Investing in international markets | Barclays Smart Investor

This is not tailored financial advice so if you're not sure about investing, seek independent advice. International share trading. International share dealing ... 於 www.barclays.co.uk -

#87.ESG Investing and Analysis - CFA Institute

What Is ESG Investing? ESG stands for Environmental, Social, and Governance. Investors are increasingly applying these non-financial factors as part of their ... 於 www.cfainstitute.org -

#88.Investing - The Balance

When you invest, you put your money into investment products, such as stocks or mutual funds, to get a return on the investment, but you also take on some risk. 於 www.thebalancemoney.com -

#89.Investing And Diversification - U.S. Department of Labor

Many employees have the ability to choose or direct their investments in their workplace retirement plans. For example, many people who participate in a 401(k) ... 於 www.dol.gov -

#90.Share Dealing | Investing - Halifax

Start investing · Find an investment · Stocks and Shares ISA · Share Dealing Account · Ready-made investments · Self-Invested Personal Pension (SIPP) · Need expert ... 於 www.halifax.co.uk -

#91.Ten Things to Consider Before You Make Investing Decisions

Invest Wisely: An Introduction to Mutual Funds. This publication explains the basics of mutual fund investing, how mutual funds work, what factors to consider ... 於 www.sec.gov -

#92.Sustainable investing in equilibrium - ScienceDirect.com

We model investing that considers environmental, social, and governance (ESG) criteria. In equilibrium, green assets have low expected returns because ... 於 www.sciencedirect.com -

#93.Start investing - ASX

Investing on ASX puts you in good company – over a third of Australians own investments that are listed on an exchange 1, ranging from shares, bonds, hybrids, ... 於 www2.asx.com.au -

#94.TD Ameritrade: Online Stock Trading, Investing, Brokerage

Explore TD Ameritrade, the best online broker for online stock trading, long-term investing, and retirement planning. 於 www.tdameritrade.com -

#95.VinFast's Billionaire Founder Is Investing His Money Elsewhere

VinFast's Billionaire Founder Is Investing His Money Elsewhere · Also, Ford has officially announced it'll slash 3,800 jobs in Europe, and Tesla ... 於 jalopnik.com -

#96.Investing.com - Wikipedia

Investing.com is a financial platform and news website; one of the top three global financial websites in the world. ... It offers market quotes, information ... 於 en.wikipedia.org